What is Monetary Policy:

Monetary policy is usually prepared by the central bank of a country, to monitor the flow of money.

Definition of Monetary Policy:

Monetary policy is mainly concerned with the process to control money supply/credit money, in order to meet certain social and economic objecting.

These point can also be consider for difference between Fiscal and Monetary Policy:

You may also like to Read

Tools of Monetary Policy:

The following tools of monetary policy are as under.

1. Open market operation:

It is the buying and selling of bonds and securities in the open market, so due to open market operation money Supply is controlled by the state bank.

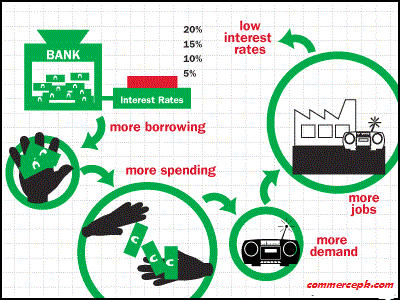

2. Bank Interest rate:

It is the rate at which control bank provide loan to the commercial banks. Thus by raising or lowering their rate money supply is controlled by the central bank of a country.

3. Credit rationing:

The control bank in order to control money supply provides credit for specific or selected purposes.

4. Bank reserve ratio:

All the commercial banks are legally bound to keep a portion of their deposit in cash form with the control bank, is called bank reserve ratio, by raising or lowering the ratio a central bank can controlled the supply of money.

5. Moral influence:

The control bank issue statistical review and information, in order and to provide a particular guide line to the commercial banks.

Objective of Monetary Policy:

The following objective of monetary policy are as under:

- To bring stability in the general price level.

- To control the supply of money / credit money in the country.

- To promote employment opportunities in the country.

- To control inflationary or deflationary situation in the country.

Fiscal Policy:

Fiscal policy is prepared by the federal government, to analyze and shaping the revenue and expenses of government.

Definition Fiscal Policy:

Fiscal policy is mainly concerned with the process of shaping government taxation and government spending so as to achieve certain objectives.

Tools of Fiscal Policy:

The following tools of fiscal policy as under

1. Taxation:

It is the one of the main source of revenue for the government. There are different kinds of tax as under

a. Direct tax:

It is directly paid by the tax payer like income tax.

b. Indirect tax:

It is not directly paid by the tax payer like general sale tax (GST).

2. Expenditure:

Government incurred a number of expenditure such as expenditure on keeping general administration, defenses, development expenditure etc.

Objective of Fiscal Policy:

Following are the main objective of fiscal policy.

- To increase employment opportunities.

- To remove regional disparity.

- To eliminate or reduce the gap between rich and poor.

- To promote employment opportunities.

- To increase investment.

- To remove regional disparity.

- To accelerate economic growth.

- To promote social welfare.

- To make possible maximum

Exploitation the available resource by increasing expenditure in the less development areas.