What is Depreciation

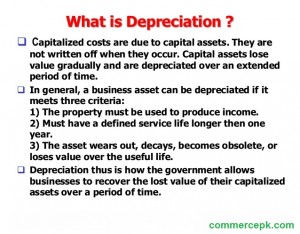

Depreciation is a gradual decrease in the value of an asset.

Explanation:

We know that when any asset is used its value decreases. This decrease in the value of asset is called its depreciation. When we purchase any asset we actually pay in advance for the services of that asset for a particular period of time as we consume those services a part of the advance payment is expired every year.

Accountant use the term “depreciation” to describe this gradual conversion of cost of an asset into expense. depreciation as the term is used is accounting does not mean the decrease in the market value of an asset but it means the allocation of the cost of a plant assets to expense in the period in which services are derived for that asset.

Causes of Depreciation:

- Wear and tear due to actual use.

- There are certain assets like leasehold property patents etc whose value diminishes with lapse of time even they are not used.

- It is the discarding of and asset on account of the invention of improved and more serviceable types or models of the assets in question.it applies to plant machinery motor vehicles etc.

- The assets like mines, quarry etc reduces their reserve with the quantum of production. At one time all reserve will be exhausted. Therefore, their value decreases with its use, this sort of depreciation is called “depletion”.

You may also like to read

Amortization:

The intangible assets whose property right is obtained for specific period of time, diminishes in value with passage of time this called as amortization.

The example are patient rights, copy right, goodwill etc similarly, the value of leasehold property also decreases with the passage of time.

Need for Depreciation:

Due to the following reason we need:

- The depreciation of fixed assets are included in the expenses for ascertaining the real cost of production.

- The depreciation expenses are calculated and deducted from the income of a particular period to ascertain the true profit/loss for the year.

- The depreciation of fixed assets is necessary to avoid the outflow of capital from the firm. If deprecation is not provided the profits will be overstated and if the owner withdraws such profits the capital of the business will go on decreasing. The restriction is also imposed by aw to avoid such withdrawal of capitals.

- The depreciation of fixed assets is necessary to provide funds for the replacement of the assets when it becomes useless.

Characteristics of Depreciation:

The following characteristic are;

- It causes perpetual gradual and continuous fall in the value of assets.

- It occurs till the last day of the estimated working life of the asset.

- It is charged against the revenue of the period.

- It is charged in case of fixed assets like building, machinery etc there is no question of depreciation of current assets like invoices receivables etc

Method of computing Depreciation:

There are many methods for the calculating the depreciation of an asset. All these methods help to ascertain estimated amount of depreciation to be charges to the revenue of the period in which the asset is used. The different method is applied for different assets according to their nature some of these methods are given as under:

- Straight line method or fixed installment method.

- Units of output method

- Declining balance method.

- Sum of year digits method