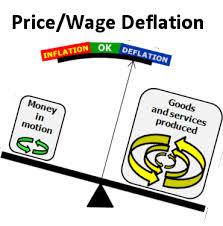

Deflation is when the overall price level decreases so that inflation rate becomes negative, it is called deflation. It is the opposite of the often-encountered inflation.

What is Deflation

A decline in general price levels, often caused by a reduction in the supply of money or credit. Deflation can also be brought about by direct contractions in spending, either in the form of a reduction in government spending, personal spending or investment spending. Deflation has often had the side effect of increasing unemployment in an economy, since the process often leads to a lower level of demand in the economy opposite of inflation.

When the overall price level decreases so that inflation rate becomes negative, it is called deflation. It is the opposite of inflation.

A reduction in money supply or credit availability is the reason for deflation in most cases. Reduced investment spending by government or individuals may also lead to this situation. Deflation leads to a problem of increased unemployment due to slack in demand.

How can deflation be harmful ?

Deflation can be harmful for economy , the below mention reason & causes why its harmful for economy.

Deflation and its causes?

Deflation can be caused by a number of factors, all of which stem from a shift in the supply-demand curve. Remember, the prices of all goods and services are heavily affected by a change in the supply and demand, which means that if demand drops in relation to supply, prices will have to drop accordingly. Also, a change in the supply and demand of a nation’s currency plays an instrumental role in setting the prices of the country’s goods and services.

you may also like to Read:

The following factors can cause deflation:

- Increased Productivity:

Advanced solutions and new procedures help increase efficiency, which finally leads to lower prices. Although some innovations only affect the productivity of certain industries, others may have a profound effect on the entire economy.

For example, after the Soviet Union collapsed in 1991, many of the countries that formed as a result struggled to get back on track. In order to make a living, many citizens were willing to work for very low prices, and as companies in the United States outsourced work to these countries, they were able to significantly reduce their operating expenses and bolster productivity. Inevitably, this increased the supply of goods and decreased their cost, which led to a period of deflation near the end of the 20th century.

- Change in Structure of Capital Markets:when many different companies are selling the same goods or services, they will typically lower their prices as a means to compete. Often, the capital structure of the economy will change and companies will have easier access to debt and equity markets, which they can use to fund new businesses or improve productivity.

There are multiple reasons why companies will have an easier time raising capital, such as declining interest rates, changing banking policies, or a change in investors’ aversion to risk. However, after they have utilized this new capital to increase productivity, they are going to have to reduce their prices to reflect the increased supply of products, which can result in deflation.

- Strictness Measures: Deflation can be the result of decreased governmental, business, or consumer spending, which means government spending cuts can lead to periods of significant deflation.

- Deflationary Spiral: Once it has shown its ugly head, it can be very difficult to get the economy under control for a number of reasons. First of all, when consumers start cutting spending, business profits decrease. Unfortunately, this means that businesses have to reduce wages and cut their own purchases. In turn, this short-circuits spending in other sectors, as other businesses and wage-earners have less money to spend. As horrible as this sound, it continues to get worse and the cycle can be very difficult to break.

- Currency Supply Decreases: As the currency supply decreases, prices will decrease so that people can afford goods. How can currency supplies decrease? One common reason is through central banking systems.

For instance, when the Federal Reserve was first created, it considerably contracted the money supply of the United States. In the process, this led to a severe case of deflation in 1913. Also, in many economies, spending is often completed on credit. Clearly, when creditors pull the plug on lending money, customers will spend less, forcing sellers to lower their prices to regain sales.

Effects of Deflation:

It can be compared to a terrible winter: The damage can be intense and be experienced for many seasons afterwards. Unfortunately, some nations never fully recover from the damage caused by deflation. Hong Kong, for example, never recovered from the deflationary effects that gripped the Asian economy in 2002.

Deflation may have any of the following impacts on an economy:

- Affects Business Revenues: Businesses must significantly reduce the prices of their products in order to stay competitive. Obviously, as they reduce their prices, their revenues start to drop. Business revenues frequently fall and recover, but deflationary cycles tend to repeat themselves multiple times.

Unfortunately, this means businesses will need to increasingly cut their prices as the period of deflation continues. Although these businesses operate with improved production efficiency, their profit margins will eventually drop, as savings from material costs are offset by reduced revenues.

- Wage Layoffs and Cutbacks:When revenues start to drop, companies need to find ways to reduce their expenses to meet their bottom line. They can make these cuts by reducing wages and cutting positions. Understandably, this exacerbates the cycle of inflation, as more would-be consumers have less to spend.

- Reduced Stake in Investments:When the economy goes through a series of deflation, investors tend to view cash as one of their best possible investments. Investors will watch their money grow simply by holding onto it. Additionally, the interest rates investors earn often decrease significantly as central banks attempt to fight deflation by reducing interest rates, which in turn reduces the amount of money they have available for spending.

In the meantime, many other investments may yield a negative return or are highly volatile, since investors are scared and companies aren’t posting profits. As investors pull out of stocks, the stock market inevitably drops.

- Changes in Customer spending: The relationship between deflation and consumer spending is complex and often difficult to predict. When the economy undergoes a period of deflation, customers often take advantage of the substantially lower prices. Initially, consumer spending may increase greatly; however, once businesses start looking for ways to bolster their bottom line, consumers who have lost their jobs or taken pay cuts must start reducing their spending as well. Of course, when they reduce their spending, the cycle of deflation worsens.

- Reduced Credit: when deflation rears its head, financial lenders quickly start to pull the plugs on many of their lending operations for a variety of reasons. First of all, as assets such as houses decline in value, customers cannot back their debt with the same collateral. In the event a borrower is unable to make their debt obligations, the lenders will be unable to recover their full investment through foreclosures or property seizures.

Also, lenders realize the financial position of borrowers is more likely to change as employers’ start cutting their workforce. Central banks will try to reduce interest rates to encourage customers to borrow and spend more, but many of them will still not be eligible for loans.

Is deflation good or bad? why is deflation bad ?

Deflation is bad because it is a loss of confidence by market contributors at huge scale that feeds on itself.

Deflation is commonly misunderstood as a fall in prices, even by economists and politicians who should know better. This confuses many as they are confused why lower prices are bad for consumers.

They are not, they are actually great, but the key is confidence of producers. If they start believing that prices will continue falling without them able to lower costs, their confidence will drop, resulting in defaults, bankruptcies and shutdowns. Such events will further depress confidence of other producers, in a malicious cycle that feeds on itself.

It is this vicious cycle that leads to terrible results and should be prevented at any cost.

Most people have no trouble understanding inflation, as in increase in supply of money relative to the amount of goods and services. Such an increase leads to rise in prices, which is a importance of inflation and not inflation itself. Note also that in an inflation there are always marginal projects that would not have been funded but for the excess of money in the system.

Is Deflation Really Bad for the Economy?

Yes, Deflation is bad for the economy in some causes while in some cases its good.