What is bill of exchange and its characteristics

According to Negotiable Instrument Act a Bill of Exchange is “An instrument in writing containing an unconditional order, signed by the maker directing a certain person to pay on demand or at a fixed or determinable future time, a certain sum of money only to, or to the order of a certain person or to the bearer of the instrument.

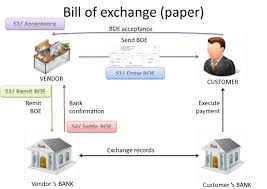

The picture Explains the process of Bill of Exchange

Bill of exchange Meaning

BOE is a document, used especially in international trade, that orders a person or organization to pay a specific sum of money at a specific time for goods or services.

You May also like to read:

Thus we find the following important characteristics of a bill of exchange:

- The order to pay a bill must be unconditional one.

- The order to pay must be made in writing on the bill.

- The bill must be signed by the drawer of the bill. Without signature of the drawer the bill will not be genuine one.

- The order to pay under a bill must be addressed to a certain person which, of course, includes individuals, firm, company, corporation etc.

- The amount to be paid under a bill must be certain one.

- The money under a bill must be paid in legal tender currency.

- The amount should be payable to or to the order of a specified person or to the bearer of the instrument.

- The amount should be payable either on demand or at a fixed determinable future time.

- The bill must be duly stamped.

- The other formalities like dating, stating the names of the parties concerned etc. must be observed.

Example of bill of exchange:

Parties in bill of exchange with example:

Following are the various parties related to a bill transaction

1.The Drawer

The person who draws the bill and puts his signature on it is known as the drawer of the bill. He is also called the “maker” of the bill.

2.The Drawee

The person on whom the bill is drawn is called as the drawee of the bill.

3.The Acceptor

The person who accepts the bill is known as the acceptor of the bill. Usually, the drawee accepts the bill. But sometimes, a third party may also accept a bill on behalf of the drawee. The acceptor puts down his signature across the bill showing his acceptance.

a.The Payee

The person to whom the amount of bill is to be paid is known as payee of the bill. The drawer may make the bill payable to himself or to any other person he likes.

b.The Endorsee

The holder of the bill may endorse the bill in favour of someone else known as endorsee. The person who endorses the bill is called endorser.

c.The Holder

The person who holds the bill and is entitled to realise the amount of the bill from the drawee is known as holder of the bill.

Different types of bill of exchange:

Bills may be of the following types:

1.Inland Bills

Inland bill means the bill which is drawn and payable within the same country. Thus, the bill which is drawn in Pakistan and will also be paid in Pakistan is termed as an inland bill.

2.Foreign Bill

The bill which is drawn in one country and accepted and payable in another country is known as a foreign bill.

3.Accommodation Bill

The bill which is drawn and accepted by the parties concerned for their mutual accommodation with a view to raise money by negotiating it, is known as an accommodation bill. The parties concerned bind themselves as the drawer and the acceptor without any valuable consideration.

a.Demand Bill

The bill which is payable “on demand” or “on presentation” or “at sight” is known as demand bill.

b.Time Bill

The bill which is payable at a fixed or a determinable future time is known as time bill. The time bill may further be classified as following:

1.After Date Bill

The bill whose tenure is counted from the date of drawing it is known as after date bill.

2.Sight Bill

The bill whose date of payment is counted from the date of acceptance is known as after sight bill.

a.Documentary Bill

When a bill is accompanied by shipping documents like, Bill of Lading, Invoice, Insurance Policy relating to goods against which the bill is drawn, is then known as a documentary bill.

b.Sent Bill Or Bills for Collection

When bills are handed over to a bander by his customer in order that they may be collected when due and the proceeds credited to the customer’s account. They are called as Bills for Collection.

c.Bills Negotiated

The bills for which the banker has given the value at once, without waiting for the proceeds after collection.

d.Bills in Set

When bills of exchange are drawn in two or more parts, they are called “bills in set”. The foreign bills are generally drawn in sets of two or three. The each of the set is on a seperate piece of paper, but all parts are worded exactly in the same language except that the parts are numbered as “The 1st of exchange”, “2nd of exchange” etc.

Bills Retired

When a bill is withdrawn from circulation or taken back before it is due, it is known as “retired bill”.

Discounting of Bills

A time bill is payable on future date and the holder of the bill is to wait for a specific period of time to receive the amount of the bill. But the modern commercial banks are providing the facilitates of discounting of bill to the holder to have money earlier. For discounting of bill, the bank purchases the bill from the holder at a reduced rate before maturing of the bill and receives the amount of the bill from the acceptor on due date. The reduction in the value of bill at the time of purchase by bank is known as “discount” and it is charged on the basis of interest rate. Thus, discounting of bill is a sort of short term credit given to the holder of the bill by a banker and the discount forms the profit to him.

Discounting of bill very useful from the point of view of traders and bankers. It benefits the importer, exporter and bankers equally. The exporter or seller can get immediate cash as soon as he handed over the goods to the transporters. The importer or buyer gets enough time to sell the goods after having received it. The bankers earn a lot by effecting these transactions.

Downloads:

- Bill of Exchange Format

- Bill of Exchange Sample