Absorption Costing Method ?

Absorption costing means that all of the manufacturing costs are absorbed by the units produced. In other words, we can say that the cost of a finished unit in inventory will include direct materials, direct labor, and both variable and fixed manufacturing overhead. Accordingly, absorption costing is also referred to as full costing or the full absorption method.

A product may absorb a wide range of fixed and variable costs. These costs are not recognized as expenses in the month when an entity pays for them. Instead, they remain in inventory as an asset until such time as the inventory is sold; at that point, they are charged to the cost of goods sold.

Absorption Costing Components

Below are the following components of absorption costing:

Direct materials. Those materials that are included in a finished product.

Direct labor. The manufacturing factory labor costs necessary to build a product.

Variable manufacturing overhead. The costs to operate a manufacturing facility, which vary with production volume. Examples are supplies and electricity for production equipment.

Fixed manufacturing overhead. The costs to operate a manufacturing facility, which do not vary with production volume. Examples are rent and insurance.

You may also like to Read

Absorption Costing Method

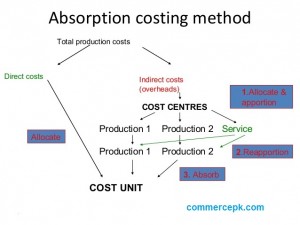

The following method is required to complete a periodic job of costs to produced goods are:

Assign costs to cost pools. This is comprised of a standard set of accounts that are always included in cost pools, and which should rarely be changed.

Calculate usage. Determine the amount of usage of whatever activity measure is used to assign overhead costs, such as machine hours or direct labor hours used.

Assign costs. Divide the usage measure into the total costs in the cost pools to arrive at the allocation rate per unit of activity, and assign overhead costs to produced goods based on this usage rate.

Overhead Absorption

Absorbed overhead is manufacturing overhead that has been applied to products or other cost objects. Overhead is usually applied based on a predetermined overhead allocation rate. Overhead is over absorbed when the amount allocated to a product or other cost object is higher than the actual amount of overhead, while the amount is under absorbed when the amount allocated is lower than the actual amount of overhead.

For example, Bilal trader’s budgets for a monthly manufacturing overhead cost of Rs 200,000, which it plans to apply to its planned monthly production volume of 100,000 widgets at the rate of Rs, 2 per widget. In July, Bilal trader’s only produced 45,000 widgets, so it allocated just Rs. 180,000. Also, the actual amount of manufacturing overhead that the company incurred in that month was Rs. 196,000. Therefore, Higgins experienced Rs16,000 of under absorbed overhead.

In August, Bilal trader’s produced 120,000 widgets, so it allocated Rs. 240,000 of overhead. Also, the actual amount of manufacturing overhead that the company incurred in that month was Rs. 218,000. Therefore, Higgins experienced Rs. 22,000 of over absorbed overhead.