Functions of money is in simple word “money is what money does”

Definition of Money:

According to an earlier German economist (knap) “anything which is declared by the state as money is money”.

According to (roger miller) “Anything which is generally accepted in payment for the goods and services or the repayment of debts is money”.

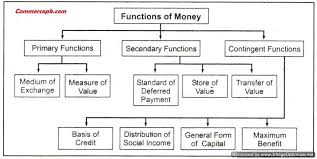

Functions of Money:

There are two major functions of money.

- Primary functions of Money.

- The secondary function of Money.

You may also like to Read

Primary Functions of Money:

1.Money as a medium of exchange:

The purchasing and selling are done through the money. In the other words, money is used as a medium of exchange, which removes the problem of double co-incidence of wants in a barter system. The money is used as a medium of exchange promoting the efficiency in the economy.

- It has reduced much of time spent in exchanging goods and services.

- It has also promoted efficiency by allowing people to specialize in any area in which they have a comparative advantage and receive money payments for labor.

2.Money as a unit of account:

The important function of the money is that it provides a unit of account. The monitory unit of account helps to measure the value of goods and services. For example, we measure weight in kg. Distances are measured in km, similarly, the value of goods and services are measured in money.

So money is a yardstick which allowed an individual to measure the comparative value of goods and services.

3.Money as a store of value:

Money also functions as a store of value. The money, which you have today, is a side to purchase a thing later on. So they wait for until he has to desire to spend it. Money held’s in the form of cash is considered highly liquid assets.

4.Money as a standard of deferred payments:

In today economy buying and selling of goods are made on the basis of credit. So money is a medium of exchange. Which are used to settle the debts maturing in future? Debts are stated and paid in terms of unit of account.

You may also Like to Read:

Secondary functions of Money:

Money has the potential to influence the economy. It influences the price level, interest rates, utilization of resources etc.

- Aid to specialization, production and trade:

The use of money helped in removing the difficulties in the barter system. The market mechanism, production of commodities. Expansion and diversions of trade etc. Have been facilitated by the use of money.

2. Money as instrument of making loan:

The people deposit their saving into the bank. The bank advances loan to the industrialist and farmers or investors. So the saving of the people is transferred to the investment.

3. Influence on income and consumption:

Money has a direct influence on the income and consumption of the country. When the production is increased due to increase in demand, so automatically the incomes will also increase. In the other words we can say that due to increase in income, the consumption of goods and services increase as compare to past.

4. Influence on the economic policy:

Money has a direct impact on the economic into the bank. The bank advances loan to the industrialist and farmers or investors. So the saving of the people is transferred to the investment.

5. Liquidity of property:

Money gives a liquid form to the property. A property can be easily converted into liquid form due to money.

6. Basic of bank credit:

Bank provides loans from their cash reserves, so the volume of money will effect due to increase or decrease the money supply.