UK Debt Interest Payments

Debt interest payments are the amount the government need to pay to holders of government bonds. It is the cost of servicing public sector debt.

- In 2016/17 the OBR forecast £49.1bn – approx 2.5% of GDP

- In 2017/18, the OBR forecast UK debt interest payments will be £55bn[1]

The level of debt interest payments depends on:

- Outstanding levels of government debt. In 2017, UK national debt was £1,737 billion equivalent to 86.5% of GDP.

- Interest rates on debt. Bond yields can rise or fall depending on economic situation. In 2017, bond yields are close to 2% – low by historical standards

- Inflation – A higher inflation rate will lead to an increased cost of index-linked gilts (bonds where interest payments are directly linked to inflation rate.) Higher inflation will also put upward pressure on interest rates.

Cost of Interest Payments £ billion

Sources for debt interest payments

- OBR Economic and Fiscal outlook March 2017 (annual) – Fiscal Supplementary tables_Expenditury (2.34)

- UK Debt-interest-payments.pdf

- Public sector spending Gov.uk

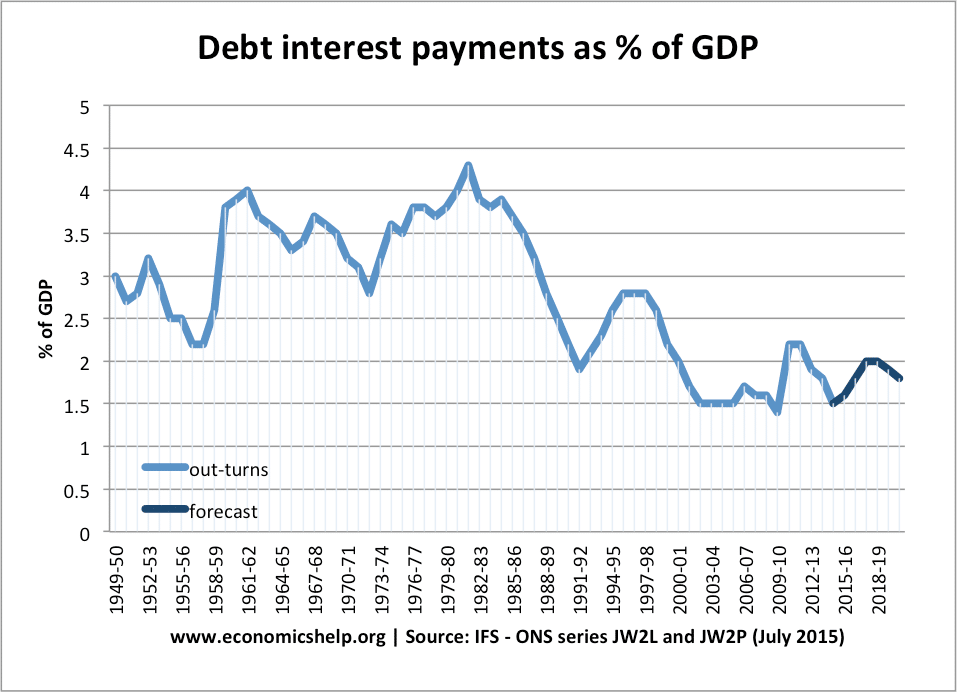

Cost of Interest Payments on UK Debt as a % of GDP

This shows that debt interest payments have averaged around 2-3% of GDP since the 1950s. Debt interest payments fell to just 1.5% of GDP during the great moderation (2000 to 2007) due to falling debt to GDP and low interest rates.

Cost of Interest Payments

- The cost of interest payments in the UK are around £49bn a year (2016/17). Approx 2.5% of GDP (UK Debt)

- In 2015/16 total government spending was £753 billion [1]. With public sector debt interest payments of £39bn (HM Treasury PSS July 2017)

Debt interest payments compared to other areas of public spending.

What determines the amount of debt interest payments?

- Level of net debt/borrowing

- Interest rates on bonds

- The interest rate is determined by the demand for government bonds.

- If demand for buying government debt falls, the price of bonds rise, pushing up bond yields, increasing the cost of borrowing.

- Some European countries like Ireland and Italy have seen rapid increases in bond yields, making it very expensive to service the debt. This is because markets worry about their ability to repay debt.

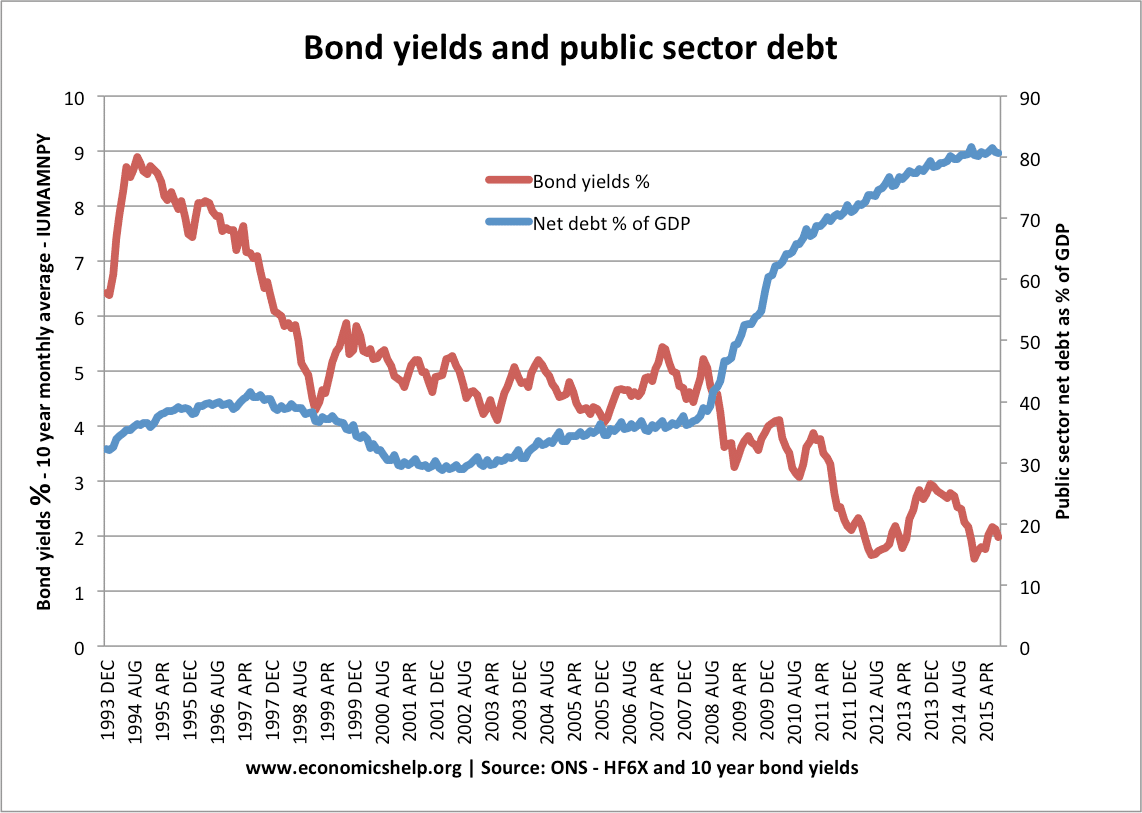

- Between 2008-17 – the UK has seen a rise in debt levels, but interest rates have actually fallen.

Falling bond yields in UK

Bond yields in the UK have fallen since 2007 because:

- Low inflation expectations

- Low expectations about economic growth have made ‘safe’ UK government bonds more attractive than riskier private sector investment

- Policy of quantitative easing and purchase of government bonds by Central Bank

- UK seen as a relative ‘safe haven’ compared to countries in the Eurozone (Being in the EUrozone makes you more vulnerable to liquidity crisis because you can’t print your own currency like the UK can)

- See also: reasons for falling bond yields

Interest Payments as % of Tax Revenue

source: World bank

You can see a table of bond maturity levels on this post – Global Debt Crisis

Cost of US Debt Interest Payments

For example, the US saw a fall in the cost of servicing its debt in 2009 because bond yields fell, despite a growth in US Debt.

Global Debt Interest Payments on Debt

- Source: OECD economic outlook, 91

Related

- UK Debt

- Global Debt Interest Payments % of GDP

- Should We worry about National Debt?

- The biggest lie in UK politics? – Is the debt issue exaggerated?

Note: There is some inconsistency in data depending on source. This is because forecasts of future debt interest payments may not be accurate

Powered by Commerce Pk