- The budget deficit is the annual amount the government has to borrow to meet the shortfall between current receipts (tax) and government spending.

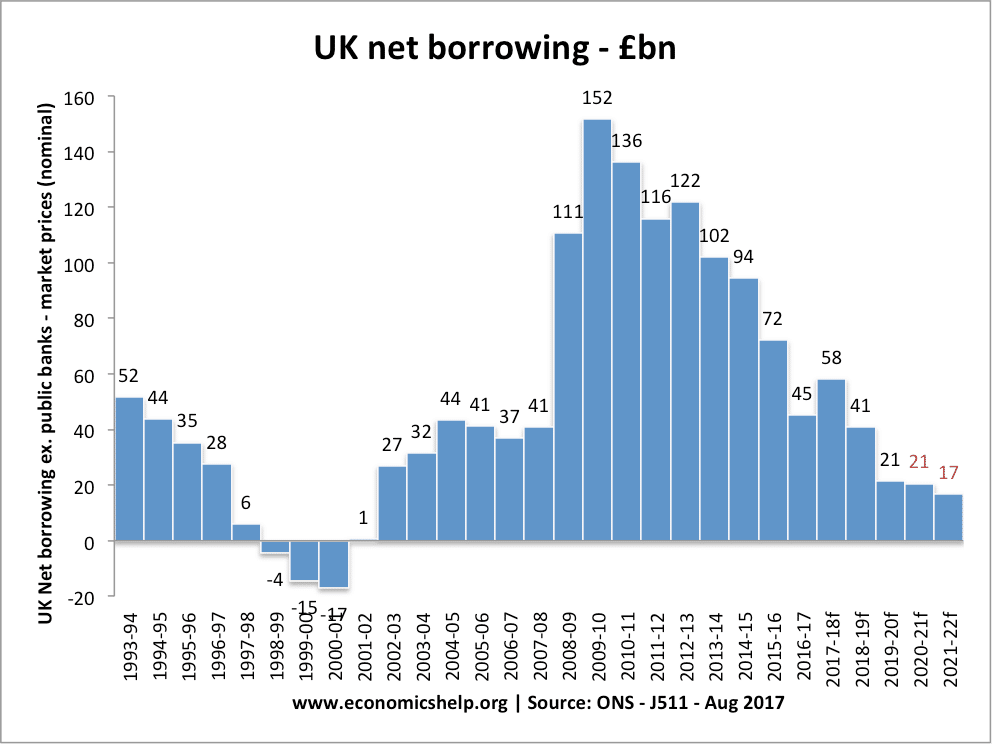

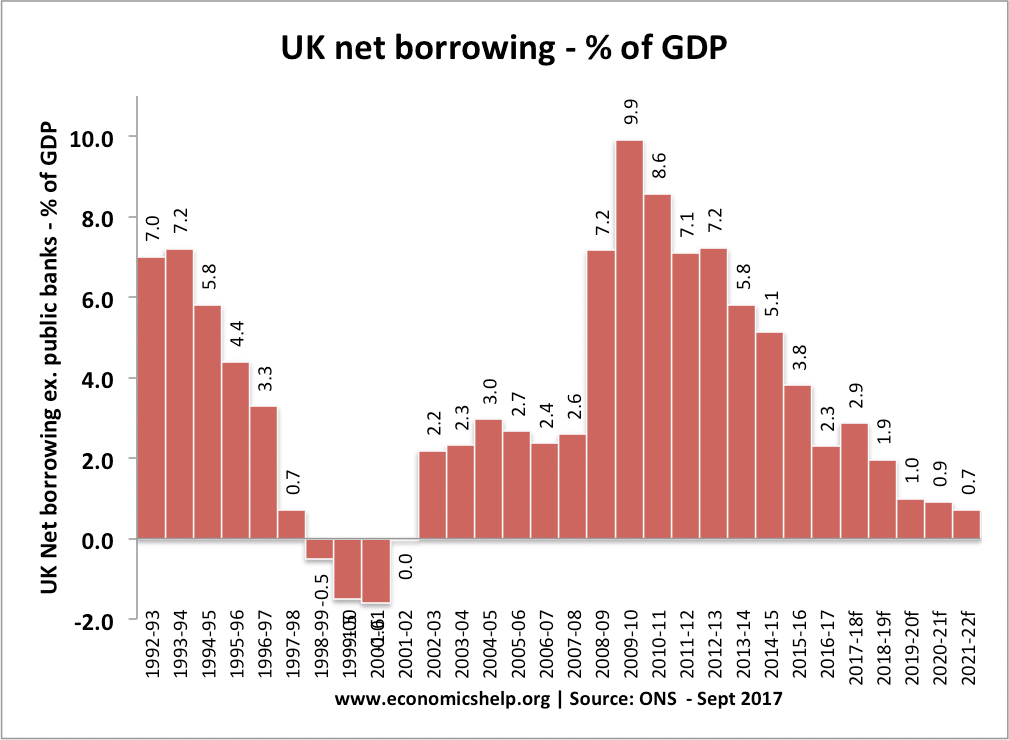

- Net borrowing for the UK 2016/17 is £45bn or 2.3% of GDP [OBR – J511]

- National debt or public sector net debt – is the total amount the government owes – accumulated over many years. See: UK national debt (Sep, 2017 – £1,737 billion equivalent to 86.5% of GDP)

UK Borrowing

Budget deficit – annual borrowing

This is the amount the government has to borrow per year.

- In 2000/01, the UK ran a budget surplus of £17bn or 1.7% of GDP

- In 2009/10 at the height of the great recession net borrowing was £152bn or 10% of GDP

- The forecast for 2017-17 is net borrowing of £58bn or 2.9% of GDP

UK net borrowing

Latest statistics at OBR

UK net borrowing as % of GDP

Figures for 2017-18 onwards are forecasts.

View: Latest statistics at OBR

Important terms related to the UK budget deficit

- Cyclical budget deficit. A cyclical budget deficit takes into account fluctuations in tax revenue and spending due to the economic cycle. For example, in a recession, tax revenues fall and spending on unemployment benefits increases.

- Structural deficit. This the level of the deficit even when the economy is at full employment.

- Primary Budget Balance – A primary budget balance means we take away interest payments on debt. (Primary budget deficits of EU) For example, if the budget deficit is £119bn, but we spend £42bn on interest payments, the primary budget deficit will be £77bn.

- Current budget. The current budget is a summary of net cash flows at that particular time.

- Net borrowing. Net borrowing includes net investment and is considered to be the main deficit figure.

- PSNB – Public sector net borrowing – another measure of annual borrowing. (ONS)

- PSNCR – Public sector net cash requirement – another measure of annual government borrowing (ONS)

- Debt interest payments – the cost of paying interest on government debt to bond holders. UK Debt Interest Payments.

Some additional notes

- Net borrowing is the current budget plus net investment. Net borrowing is considered the main figure for the government deficit.

- In 2012/13, public sector net borrowing and public sector net investment were reduced by £28bn as a result of the transfer of the Royal Mail Pension Plan.

Record budget deficits in 2009/10 recession

Net borrowing reached a peak in 2009/10 with £167.4bn. This was due to:

- The financial crisis which led to falling tax revenues, e.g. lower incomes led to less income tax revenue; fewer house sales led to lower stamp duty.

- Expansionary fiscal policy including VAT cut

- Higher spending on unemployment benefits during the recession.

- Long term spending commitments, e.g. government spending increases in the early 2000s.

Other sources of budget deficit figures

Source: Public Sector Finances at HM Treasury | Public Sector Finances at ONS

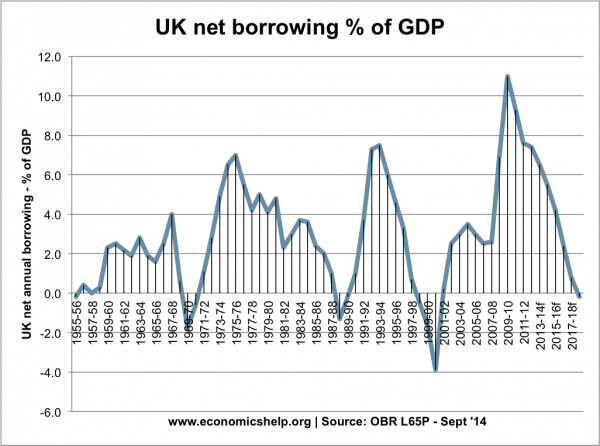

UK Budget deficit history

UK net borrowing since 1955 as a % of GDP.

Factors that affect the size of the budget deficit

1. Economic cycle. During a recession it is likely that there will be an increase in the budget deficit. This is because:

- Tax revenues will be lower.

- less people are working therefore income tax will be less

- Consumer spending is lower therefore VAT receipts are lower

- Firms make less profit, therefore a fall in corporation tax.

- Government spending will increase:

- More will be spent on unemployment and welfare benefits

2. Level of interest payments. Higher bond yields will increase interest payments and the budget deficit.

3. One-off Receipts. A governments budget balance may be improved through one off payments, such as receiving income from privatisation of state owned assets.

4. Structural deficit. If the government commit to investing in infrastructure, there will be higher borrowing. For example, higher government spending increased in the early 2000s contributing to an underlying structural budget deficit.

5. Fiscal Policy. Expansionary fiscal policy involves higher spending and lower taxes which will increase the size of the budget deficit.

Effects of a budget deficit

- Rise in national debt

- Higher borrowing leads to increase in aggregate demand (AD)

- May cause crowding out (higher government spending at expense of private sector)

See more detail at: Effects of a budget deficit

Related concepts

- Total debt shows the total amount that the government owe, accumulated over many years. This is referred to as public sector net debt or national debt. See: UK National Debt

- Don’t get confuse the budget deficit with the trade deficit, this occurs when imports are greater than exports.

Official definition of borrowing net borrowing can be defined as the difference between total accrued revenue (or receipts) and total accrued expenditure (both current and capital). Net borrowing is an accrued measure which is consolidated (i.e. intra sector transactions are not recorded). ONS sheet pdf

During periods when the public sector revenue exceeds its expenditure then the public sector is able to repay some of its debt rather than borrow further. When there is a repayment the public sector net borrowing is shown as a negative.

Related

- UK national debt

- Effects of a budget deficit

- How to reduce a budget deficit

Powered by Commerce Pk