Define Special Journal in Accounting

Special Journal is any accounting journal in the general journal that is used to record and post similar types of transactions.

We can also define , it’s a place where similar transactions can be recorded and organized, so bookkeepers and accountants can keep track of different business activities.

Special Journals

Special Journals also known as subsidiary journals are chronological records of frequently occurring transactions such as sales, purchases and cash receipts/payments.

Repetitive transactions such as sales and purchases are recorded in special journals and the totals of these journals are transferred to general ledger on a regular basis such as daily, weekly or monthly as if a single transaction has occurred in this interval.

Special journals mostly deal with subsidiary accounts but this is not a rule. For example, purchase journal is typically used to record credit purchase and the accounts involved are individual creditors’ accounts (these are subsidiary accounts) and purchase account which a general ledger account.

Businesses may need to record countless purchase transactions per day. Recording all such transaction directly in general journal would be extremely time consuming and error prone. It is much easier and simple to summarize all sales transactions during a week, for example, and transfer the total amount to general records.

You May also Read to Like

Special Journals Proforma:

S.J are in the form of a table of numerous rows and multiple columns. Each transaction takes a single row. The names of columns vary based on the type of transaction in a special journal.

Special Purchase Journal

| Date | Invoice | Vendor Account Credited | Ref | Account Payable | Purchase (Dr.) |

Special Sales Journal

| Date | Invoice | Customer Account Debited | Ref | Account Receivable | Sales (Cr.) |

Special Journals and Subsidiary journals Examples:

Accounts Receivable and accounts payable are examples of Subsidiary journals.

Special journals examples which are commonly used are:

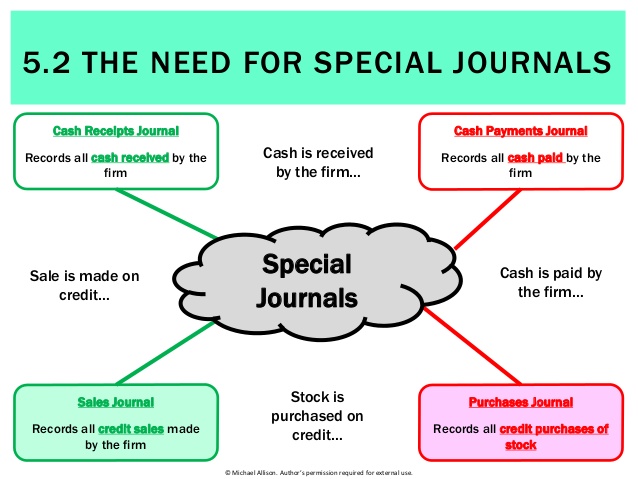

Types of Special Journals

- Purchases Journal

- Purchase Returns Journal

- Sales Journal

- Sales Return Journal

- Cash Receipts Journal

- Cash Payments Journal

Purchases Journal and Cash Payment Journal:

Special Journals purchases are used to record transaction of purchase and cash payment journal are used to record transaction of cash payment against purchases.

Sales Journal and Cash Receipts Journal:

Special Journals Sales are used to record transaction of sales and cash receipt journal are used to record transaction of cash receipt against sales.

Advantages of Special Journals:

In a difficult system, there are more repetitive transactions according to type like sales, purchases, cash and others therefore the need to provide a separate special journal for each type. Entries not of a repetitive nature like corrections, adjusting entries and closing entries are entered into the general journal.

Reduces detailed recording :

Using the special journals concept, individual posting is eliminated. Only one posting for the total amount is made to the appropriate ledger account at the end of the accounting month.

For example, if a company had 400 purchases on account during the month, the purchases account would only be debited one, not 400 times

Permits better division of labor.

Each special journal can be handled by a different person allowing specialization and making the work more efficient.

Permits better internal control.

Allocation of work of special journal to individual person confirms that no one person has incompatible responsibilities like the receipt and recording of cash which ensure better internal control.

The need of Special Journal:

If you want to learn more about Special Journal kindly visit: