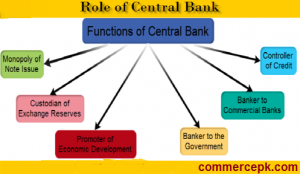

Functions of Central bank are many but some of the main functions of central bank are, act as a governor of machinery of credit, regulate volume of credit and currency, control banking interest rate in country , we discuss below the following main functions of central bank.

Functions of Central Bank:

The traditional functions of central bank are discuss below;

- Monopoly in issuing currency notes

- Bank To The Government

- As Banker To The Government

- As An Agent Of The Government

- Saving / Profit & Loss Sharing Account

- Advancing Loans

- Ordinary Loans:

- Non-Commercial Functions of Central Bank

- Creation of Credit

- Misc Functions

The explanation of these functions are as under;

Monopoly in issuing currency notes:

Formerly in certain countries, many banks issued their own notes. This resulted in uncontrolled confusion. Hence, gradually the right of note issue was withdrawn from ordinary banks. Note issue became the sole privilege of the central bank. Today the central bank in every country enjoys the exclusive privilege of bank note issue.

Bank To The Government:

This function of a central bank may be studied under the following two heads.

As Banker To The Government :

As governments banker, the central bank keep the deposits or banking accounts of government departments boards and enterprises. It advances short term loans to the government in anticipation of collection of taxes or the raising of loans from the public. It also makes extra-ordinary advances during depression, war or other national emergencies.

As An Agent Of The Government:

As an agent of the government the central bank is often entrusted with the management of the public debt and issue of new loans and treasury bills on behalf of the government. Moreover the central bank is the fiscal agent to the government and receives taxes and other payments into its account..

Saving / Profit & Loss Sharing Account:

All the banks in Pakistan nearly have started accepting deposits only under Profit and Loss Sharing Accounts where the depositors share in profit and loss instead of getting interest (Commonly known as Profit).

You may also like to Read:

Advancing Loans:

The second important function of a commercial bank is to advance loans. The banks advance certain types of loans to their customers such as:

Ordinary Loans:

Here the banks give a specified sum of money to a person or firm against some collateral security. The loan money is credited to the account of the customer and he can withdraw the money according to his requirements.

Non-Commercial Functions of Central Bank:

The non-commercial functions of the commercial banks are as follows.

- Agency Functions

Commercial banks act as the agents of their customers and perform agency functions as transfer of funds from one place to another. Collecting customer’s funds and crediting the same to their accounts. Purchase and Sale of shares and securities, collecting dividends on the shares of the customers and payments of insurance premium on policies of the customers. - Purchase and Sale of Foreign Exchange

The bank also carries on the business of buying and selling of foreign currencies Ordinarily their functions is performed by specialized banks known as Foreign Exchange Banks. - Financing Internal & Foreign Trade

The bank finances internal and foreign trade through discounting of exchange of bills. This discounting business greatly finances the movement of internal and foreign trade. - Creation of Credit:

this is the vital functions of Central bank When the bank grants loan to its customers it opens an account in the borrowers name and credits the amount of the loan. Since the deposits of the bank circulate as money the creation of such deposits lead to a net increase in the money stock of the economy. This is known as Creation of Credit. - Miscellaneous Functions:

Bank performs different kinds of various services other than described above such as collect utility of bills on behalf of Government and other authorities. Provide valuable advice to customers about trade and business provide information about sale and purchase of shares and act according to Government policy like deduction of Zakat and Islamic blessing System etc.

if you want to learn more about Central bank Functions kindly visit