Long-Term Care Insurance Cost 2023

A whole bunch of shoppers name the Affiliation workplaces every year and lots of ask comparable questions: “How does Long-Term Care Insurance Cost?” “How do I do know what to purchase?” “What’s the fitting age to purchase?”

First, I’m glad they name our workers. That’s what we’re right here to do — and you must be happy to name us at (810) 797-3777 to reply your questions. However, whereas we will supply normal info, on the finish of the day no two individuals (or) are the identical … no two monetary conditions precisely the identical. And your long-term care plan should meet your wants and price range.

So the quick reply to “How a lot does long-term care insurance coverage price?” is “It relies upon!” It is determined by how a lot safety you purchase. It is determined by the age if you apply and your wellbeing if you apply. It even is determined by which insurance coverage firm you get charges from.

What’s The Greatest Age to Begin Lengthy-Time period Care Planning?

You might have seen that the phrase “insurance coverage” is lacking from the headline above. That is as a result of everybody must do some long-term care planning. BUT, NOT EVERYONE should buy long-term care insurance coverage.

That is an vital level since you wish to begin long-term care planning WHEN YOU HAVE THE MOST OPTIONS. Due to the necessity to “well-being qualify” for long-term care insurance coverage, it’s essential begin planning when you’re nonetheless in comparatively good well-being.

The perfect time to begin planning is between ages 52 and 64.

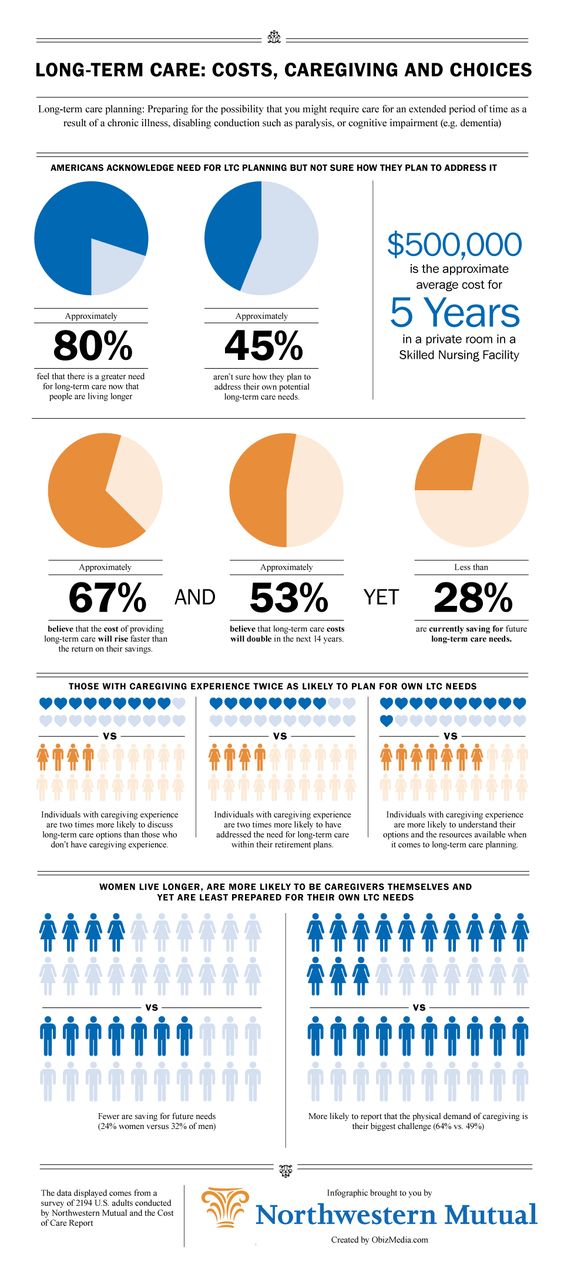

Here is why! Yearly the American Affiliation for Lengthy-Time period Care Insurance coverage surveys insurers. In 2011, we gathered knowledge on new coverage functions based mostly on over 150,000 folks.

PERCENTAGE OF APPLICANTS DECLINED FOR COVERAGE

- Beneath age 50: 11%

- Ages 50-to-59: 17%

- Ages 60-to-69: 24%

- Ages 70-to-79: 45%

Bear in mind, these are individuals who the insurance coverage agent felt might need an opportunity of qualifying. They crammed out a prolonged utility solely to be rejected.

There’s a nice saying: “With regards to long-term care insurance coverage, you cash pays for it … however YOUR HEALTH Buys it!” That is why we advocate that planning begin between ages 52 and 64.

long-term care insurance cost for Seniors at age 70

Lengthy Time period Care Insurance coverage is personal insurance coverage designed to assist pay for nursing dwelling or dwelling well being care bills. It’s accessible to people and could also be accessible underneath a bunch coverage. You pay a premium to an insurer in return for cover in opposition to the excessive prices of long-term care. Lengthy-Time period Care could be costly; particularly for retirees dwelling on a hard and fast finances. The truth is that one-in-three long-term care coverage holders will wind up utilizing their long-term care coverage sooner or later of their retirement.

|

A protracted-term coverage is meant to pay for in-home, assisted dwelling or nursing dwelling care. Sometimes, advantages can be triggered by diminished psychological capability, as with Alzheimer’s, or if you cannot carry out actions of each day dwelling: strolling, dressing, bathing or consuming as an illustration. Many insurers spell out a listing of actions; you should be unable to do a sure variety of them for advantages to kick in.

The price of premiums depends upon the insurer, in addition to the coverage’s provisions. Some provisions will have an effect on your worth greater than others. Sometimes, you may’t get a long-term coverage after age 79.

Yearly premium prices

In response to the American Affiliation for Lengthy Time period Care Insurance coverage a 55-year-old single male buying new long-term care insurance coverage safety can count on to pay a mean of $925-per-year for $164,000 of advantages. He’ll pay $1,765 for protection that will increase the profit pool to $365,000 at age 85. Insurance policies providing $100 a day in advantages with a 5% annual inflation safety and a 90-day deductible now common over $5000 a 12 months up from up from $1982 seven years in the past. Premiums on insurance policies have greater than doubled through the years as persons are dwelling longer and they’ll proceed to extend at 5% a 12 months and probably extra in years to come back as some insurers are getting out of the enterprise.

Long term care insurance cost estimate

I normally reply to this generally requested query with “How a lot does a automobile value?”

There are a number of choices that adjust the value, however the core choices are defined below the “LTCI Advantages” class on this web site within the excerpt from my guide The ABC’s of Lengthy-Time period Care Insurance coverage known as “Your Custom-made Profit Choice Course of”:

- each day or month-to-month profit (you need month-to-month for dwelling care)

- ready interval earlier than advantages begin (one-time deductible)

- inflation safety (BUY IT)

- dwelling wellbeing care profit (to incorporate or to not embrace or embrace at a decrease degree)

- profit interval/profit most (lifetime most for advantages)

After I began my great profession within the long-term care insurance coverage business in 1988, I noticed how little anybody knew in regards to the topic. To get the phrase out, I did an academic seminar throughout my metropolis of 250,000 folks. The one I placed on the viewers have been:

- they have been a broad combination of ages since long-term care impacts your complete household; and

- they’ve belongings to guard in order that the acquisition of long-term care insurance coverage could be financially appropriate for them.

Having stated that final one, although, I’ve had grownup youngsters purchase long-term care insurance coverage on their mother and father as a result of they need their mother and father to be handled like a private-pay affected person when the mother and father want long-term care. This implies many extra selections that the Medicaid program provides. Conversely – and this may make you smile slightly – I’ve had mother and father purchase long-term care insurance coverage on these “20-somethings” as a result of they know if that younger son or daughter had a head harm as a consequence of an accident or developed a severe continual situation, they as mother and father could be accountable. That normally occurs within the office when staff are uncovered to long-term care insurance coverage.

My seminars have been generic which suggests they didn’t point out a selected product or insurance coverage firm – simply good primary details about why folks even want long-term care insurance coverage. The second half of the seminar defined how one goes about choosing the advantages on a coverage to get probably the most worth for the least quantity of premium. In different phrases, I simply defined what I had wished to know after I received into the sector of LTCI. And the massive questions I had have been “How a lot does this insurance coverage value? Can I afford it?”

So I developed a strong plan that can pay two-thirds of the price of care in a lot of the nation and one other one that can do the identical in these high-cost areas like New York, New England and elements of California. Right here’s the plan:

| Many of the U.S. | Excessive-Price Areas | |

| Day by day/Month-to-month Profit | $150/$4500 | $250/$7500 |

| Ready Interval (one-time) | 90 days | 90 days |

| Inflation Safety | 5% compound | 5% compound |

| House Care Profit | 100% | 100% |

| Profit Interval/Profit Most | three years | three years |

The Lengthy-Time period Care Partnership is absolutely what makes this work. The #1 factor that non-buyers report will trigger them to contemplate long-term care insurance coverage is that the federal government will begin paying when the long-term care insurance coverage advantages run out. (Supply: LifePlans LTCI Purchaser-NonBuyer Surveys, 2011) That’s precisely what occurs within the Partnership states if you happen to meet the state’s standards for being bodily or cognitively impaired. Plus, you get to maintain belongings equal to the advantages paid out by your long-term care insurance coverage coverage along with what your state means that you can hold as a Medicaid affected person (see “The Partnership for Lengthy-Time period Care” and “What Your State Lets You Maintain” below Legal guidelines and Laws on this web site).

So to see what that premium averages for you, please enter these components under:

Age (precise age and know that almost all firms enable a 30 day grace interval to get an software in after your birthday) and marital or associate standing:

- single or married and not using a partner or associate issued

- married or with a associate and each of you count on to be lined

You will notice the typical month-to-month and annual premium for each plans. You’ll be able to pay semi-annual or quarterly as nicely, however that is simply to present you an thought. Additionally, you will see that month-to-month creates a load of about 9%, which is like paying an additional month-to-month cost. Month-to-month additionally needs to be drafted out of your checking account and a few individuals are squeamish about that. A few carriers settle for a credit score or debit card however that’s not widespread. In case you will pay one of many different modes with annual being the least costly, you get monetary savings.

Well being: You can too get monetary savings if you happen to qualify for a most well-liked well being low cost which ranges from 5%-15%, relying on the service. Usually, it’s essential to have an inexpensive peak/weight ratio, be a non-smoker, and take no a couple of medicine. The medicine half is difficult – it needs to be for a situation that’s nicely below management. For instance, it may very well be to manage hypertension or ldl cholesterol and there must be no dosage or frequency modifications within the final six months or a change to a different medicine. So enter these components right here and see the typical premiums:

Costly, you say? Please don’t go away this web page till you take into account – are you prepared???

The LTC Insurance coverage Worth Proposition: After you see the typical premium for these plans, multiply the premium by 30 years, then evaluate the quantity of premium to what the advantages will likely be in 30 years.

Many of the US Plan: $600 each day profit x three x 365 = $657,000

Excessive-Price Areas: $1000 each day profit x three x 365 = $1,095,000

Notice: It’s straightforward to do that with any plan that has the 5% compound inflation safety, as a result of at 5% compound, the advantages double each 15 years. Right here’s the way it works:

- $150 x 2 = $300 in 15 years; $300 x 2 = $600 in 30 years

- $250 x 2 = $500 in 15 years; $500 x 2 = $1000 in 30 years

In case you and your partner/associate are issued a coverage, the profit quantities are double; i.e. $1,314,000 for each of you on the decrease plan ($657,000 x 2) and $2,190,000 ($1,095,000 x 2) on the upper plan. In case you take a profit known as “shared care”, you possibly can have entry to one another’s advantages whereas dwelling and inherit unused advantages when a partner/associate dies.

What’s the purpose? The purpose is that every little thing is pricey however it’s a must to say “in comparison with what?” In case you evaluate the premium you pay in to the advantages accessible, impulsively the premium seems small. Plus, the premium stops whenever you begin receiving advantages and a few plans provide the choice to pay slightly extra and have it cease on each of you in case you are a part of a pair.

In fact it’s a must to qualify medically for a plan, and the youthful you might be, the larger the possibility that you’ll qualify and the much less a plan will value for you.

AARP Long Term Care Options – From New York Life-Learn More

AARP has been an advocate of Lengthy Time period Care Insurance coverage and has some glorious protection on the subject on their web site. Should you’re searching for AARP’s LTC insurance coverage charges, nonetheless, learn on…

As of 2015, AARP was nonetheless with out an endorsed coverage possibility, however in 2016 that modified. In years previous, the AARP Lengthy Time period Care Insurance coverage plan was one of many premium LTC insurance policies in the marketplace. AARP-endorsed plans all the time had aggressive charges and have historically included additional bells and whistles. AARP endorses top-quality firms in all of its merchandise, starting from journey to insurance coverage to cellular phone plans.

In late 2013, AARP’s advertising and marketing settlement with Genworth Lengthy Time period Care ceased to exist, leaving AARP members with the liberty to not choose from only one provider, however from many plans on the aggressive market.

2023 Replace: AARP now endorses a product from NY Life.

Save Cash by Evaluating Lengthy Time period Care Fee Plans

Like just about any insurance coverage plan, the secret’s to examine plans from numerous carriers, and we constructed the CompareLongTermCare.org comparability market only for that objective. By viewing competing premiums from the most important A+ rated “blue chip” insurance coverage firms side-by-side, you might be shortly capable of finding the nexus of worth and firm power. By that we imply it might be price paying a bit extra if you’ll be able to purchase protection from a financially-superior insurance coverage plan.

Prior to now, AARP endorsed MetLife LTC plans, then moved to Genworth after a number of years, and now works with New York Life. B

Pattern AARP Lengthy Time period Care Insurance coverage Premiums from the Previous

We ran some historic charges of previous AARP LTC coverage types. Listed below are pattern premiums for a $5,000/mo profit, 5 years, with no automated inflation safety, for a 60-year outdated single male:

Understanding Long Term Care Insurance – AARP

uying a long-term care insurance coverage coverage could be costly, however there are steps you’ll be able to take to make it extra reasonably priced and versatile.

En español |The phrase “long-term care” refers back to the assist that folks with persistent sicknesses, disabilities or different situations want every day over an prolonged time frame. The kind of assist wanted can vary from help with easy actions (akin to bathing, dressing and consuming) to expert care that is supplied by nurses, therapists or different professionals.

Employer-based well being protection won’t pay for every day, prolonged care providers. Medicare will cowl a brief keep in a nursing house, or a restricted quantity of at-home care, however solely beneath very strict situations. To assist cowl potential long-term care bills, some individuals select to purchase long-term care insurance coverage.

Insurance policies provide many alternative protection choices. Since you’ll be able to’t predict what your future long-term care wants might be, chances are you’ll need to purchase a coverage with versatile choices. Relying on the coverage choices you choose, long-term care insurance coverage can assist you pay for the care you want, whether or not you might be residing at house or in an assisted residing facility or nursing house. The insurance coverage may additionally pay bills for grownup day care, care coordination and different providers. Some insurance policies will even assist pay prices related to modifying your private home so you’ll be able to preserve residing in it safely.

Elements to contemplate

Your age and well being: Insurance policies value much less if bought once you’re youthful and in good well being. When you’re older or have a severe well being situation, chances are you’ll not be capable of get protection — and for those who do, you might have to spend significantly extra.

The premiums: Will you be capable of pay the coverage’s premiums — now and sooner or later — with out breaking your finances? Premiums typically enhance over time, and your earnings could go down. If you end up unable to afford the premiums, you may lose all the cash you have invested in a coverage.

Your earnings: If in case you have issue paying your payments now or are involved about paying them within the years forward, when you might have fewer property, spending hundreds of a yr for a long-term care coverage may not make sense. In case your earnings is low and you’ve got few property once you want care, you may rapidly qualify for Medicaid. (Medicaid pays for nursing house care; in most states it’s going to additionally cowl a restricted quantity of at-home care.) Sadly, as a way to qualify for Medicaid you have to first exhaust nearly all of your sources and meet Medicaid’s different eligibility necessities.

Your assist system: You will have household and associates who can present a few of your long-term care do you have to want it. Take into consideration whether or not or not you’ll need their assist and the way a lot you’ll be able to fairly count on from them.

Your financial savings and investments: A monetary adviser — or a lawyer who makes a speciality of elder regulation or property planning — can advise you about methods to avoid wasting for future long-term care bills and the professionals and cons of buying long-term care insurance coverage.

Your taxes: The advantages paid out by means of a long-term care coverage are typically not taxed as earnings. Additionally, most insurance policies offered as we speak are “tax-qualified” by federal requirements. This implies for those who itemize deductions and have medical prices in extra of seven.5 p.c of your adjusted gross earnings you’ll be able to deduct the worth of the premiums out of your federal earnings taxes. The quantity of the federal deduction relies on your age. Many states additionally provide restricted tax deductions or credit.

Lengthy-term care coverage sources

Particular person plans: Most individuals purchase long-term care insurance policies by means of an insurance coverage agent or dealer. When you go this route, be certain that the particular person you are working with has had further coaching in long-term care insurance coverage (many states require it) and verify along with your state’s insurance coverage division to verify that the particular person is licensed to promote insurance coverage in your state.

Employer-sponsored plans: Some employers provide group long-term care insurance policies or make particular person insurance policies obtainable at discounted group charges. Numerous group plans do not embrace underwriting, which implies chances are you’ll not have to satisfy medical necessities to qualify, a minimum of initially. Advantages may be obtainable to relations, who should pay premiums and may must cross medical screenings. Most often, for those who depart the employer or the employer stops offering the profit, you’ll retain the coverage or obtain an analogous providing for those who proceed to pay the premiums.

Plans provided by organizations: Knowledgeable or service group you belong to may provide group-rate long-term care insurance coverage insurance policies to its members. Simply as with employer-sponsored protection, examine your choices so you may know what would occur if protection had been terminated or for those who had been to go away the group.

State partnership applications: If you buy a long-term care insurance coverage coverage that qualifies for the State Partnership Program you’ll be able to preserve a specified quantity of property and nonetheless qualify for Medicaid. Most states have a State Partnership Program. You should definitely ask your insurance coverage agent whether or not the coverage you are contemplating qualifies beneath the State Partnership Program, the way it works with Medicaid, and when and the way you’ll qualify for Medicaid. If in case you have extra questions on Medicaid and the partnership program in your state, verify along with your State Well being Insurance coverage Help Program.

Joint insurance policies: These plans allow you to purchase a single coverage that covers multiple particular person. The coverage can be utilized by a husband and spouse, two companions, or two associated adults. Nevertheless, there may be often a complete or most profit that applies to everybody insured beneath the coverage. As an illustration, if a pair has a coverage with a $100,000 most profit and one particular person makes use of $40,000, the opposite particular person would have $60,000 left for his or her personal providers. With such a joint coverage you run the chance of 1 particular person depleting funds that the opposite associate may want.

Lengthy-term care insurance policies and preexisting situations

Insurers typically flip down candidates as a result of preexisting situations. If an organization does promote a coverage to somebody with preexisting situations, it typically withholds fee for care associated to these situations for a specified time frame after the coverage is offered. Be certain this era of withheld funds is cheap for you. When you fail to inform an organization of a earlier situation, the corporate could not pay for care associated to that situation.

Most corporations will present an off-the-cuff assessment to find out whether or not you might be eligible for the coverage. That is useful for those who’re prone to be denied protection since one other firm could ask whether or not you have ever been turned down for protection.

Coated providers

Some insurance coverage corporations require you to make use of providers from a licensed house care company or a licensed skilled, whereas others permit you to rent impartial or non-licensed suppliers or relations. Corporations could place sure — akin to licensure, if obtainable in your state — or restrictions on amenities or applications used. Be sure you purchase a coverage that covers the kinds of amenities, applications and providers you may need and which can be obtainable the place you reside. (Shifting to a different space may make a distinction in your protection and the kinds of providers obtainable.)

Insurance policies could cowl the next care preparations:

Nursing house: A facility that gives a full vary of expert well being care, rehabilitation care, private care and every day actions in a 24/7 setting. Discover out whether or not the coverage covers greater than room-and-board.

Assisted residing: A residence with apartment-style items that makes private care and different individualized providers (akin to meal supply) obtainable when wanted.

Grownup day care providers: A program exterior the house that gives well being, social and different assist providers in a supervised setting for adults who want a point of assist in the course of the day.

Dwelling care: An company or particular person who performs providers, akin to bathing, grooming and assist with chores and home tasks.

Dwelling modification: Diversifications, akin to putting in ramps or seize bars to make your private home safer and extra accessible.

Care coordination: Providers supplied by a educated or licensed skilled who assists with figuring out wants, finding providers and arranging for care. The coverage may cowl the monitoring of care suppliers.

Future service choices: If a brand new sort of long-term care service is developed after you buy the insurance coverage, some insurance policies have the flexibleness to cowl the brand new providers. The “future service” possibility could also be obtainable if the coverage comprises particular language about different choices.

Coverage protection quantities and limits

Lengthy-term care insurance policies will pay totally different quantities for various providers (akin to $50 a day for house care and $100 a day for nursing house care), or they might pay one price for any service. Most insurance policies have some sort of restrict to the quantity of advantages you’ll be able to obtain, akin to a selected variety of years or a total-dollar quantity. When buying a coverage you choose the profit quantity and length to suit your finances and anticipated wants.

“Pooled advantages” permit you to use a total-dollar quantity of advantages for several types of providers. With this protection possibility you’ll be able to mix providers that meet your explicit wants.

To find out how helpful a coverage might be to you, evaluate the quantity of your coverage’s every day advantages with the common value of care in your space and bear in mind that you will have to pay the distinction. As the worth of care will increase over time, your profit will begin to erode until you choose inflation safety in your coverage.

Qualifying for advantages

“Profit triggers” are the situations that should happen earlier than you begin receiving your advantages. Most corporations look to your incapability to carry out sure “actions of every day residing” (ADLs) to determine when you can begin to obtain advantages.

Typically, advantages start once you need assistance with two or three ADLs. Requiring help with bathing, consuming, dressing, utilizing the bathroom, strolling and remaining continent are the most typical ADLs used. You ought to be certain your coverage contains bathing within the listing of profit triggers as a result of that is typically the primary process that turns into not possible to do alone.

Pay shut consideration to what the coverage makes use of as a set off for paying advantages for those who develop a cognitive impairment, akin to Alzheimer’s illness. It’s because an individual with Alzheimer’s could also be bodily capable of carry out actions however is now not able to doing them with out assist. Psychological-function checks are generally substituted as profit triggers for cognitive impairments. Ask whether or not you have to require somebody to carry out the exercise for you, reasonably than simply stand by and supervise you, as a way to set off advantages.

Protection exclusions

All insurance policies have some situations for which they exclude protection. Ask the agent to assessment these exclusions with you. Most states have outlawed corporations from requiring you to have been in a hospital or nursing facility for a selected variety of days earlier than qualifying for advantages. Nevertheless, some states allow this exclusion, which might preserve you from ever qualifying for a profit.

Protection exclusions for drug and alcohol abuse, psychological issues and self-inflicted accidents are widespread. Make certain that Alzheimer’s illness and different widespread sicknesses, akin to coronary heart illness, diabetes or sure types of most cancers, aren’t talked about as causes to not pay advantages.

Ready and elimination durations

Most insurance policies embrace a ready or elimination interval earlier than the insurance coverage firm begins to pay. This era is expressed within the variety of days after you might be licensed as “eligible for advantages,” as soon as you’ll be able to now not carry out the required variety of ADLs. You’ll be able to usually select from zero as much as 100 days. Fastidiously calculate what number of days you’ll be able to afford to pay by yourself earlier than protection kicks in. (The shorter the interval, the upper the worth of the coverage.)

Select a coverage that requires you to fulfill your elimination interval solely as soon as in the course of the lifetime of the coverage reasonably than a coverage that makes you wait after every new sickness or want for care.

Many insurance policies permit you to cease paying your premium after you have began receiving advantages. Some corporations waive premiums instantly whereas others waive them after a sure variety of days.

Lengthy-term care advantages and inflation

Since many individuals buy long-term care insurance coverage 10, 20 or 30 years earlier than receiving advantages, inflation safety is a crucial possibility to contemplate. Indexing to inflation permits the every day profit you select to maintain up with the rising value of care.

You’ll be able to enhance your profit by a given p.c (5 p.c is usually beneficial) with both compound or easy inflation safety. When you’re beneath age 70 once you purchase long-term care insurance coverage, it is in all probability higher to have automated “compound” inflation safety. Because of this the quantity of your every day profit enhance might be primarily based on the upper quantity of protection at every anniversary date of the coverage. “Easy” inflation safety will increase your every day profit by a set share of the unique profit quantity. Usually, the easy possibility will not preserve tempo with the worth of providers.

In lieu of automated will increase, some insurance policies provide “future-purchase choices” or “guaranteed-purchase choices.” These insurance policies typically begin out with extra restricted protection and a corresponding decrease premium. At a later, designated time, you might have the choice of accelerating your protection — albeit at a considerably elevated premium.

When you flip down the choice a number of occasions, chances are you’ll lose the flexibility to extend the profit sooner or later. With out growing your protection this selection could depart you with a coverage that covers solely a fraction of your value of care. The youthful you might be once you purchase long-term care insurance coverage, the extra necessary it’s to purchase a coverage with inflation safety.

Premium will increase and coverage cancellations

Corporations cannot single you out for a price enhance. Nevertheless, they’ll enhance charges on a category of comparable insurance policies in your state. Most premiums do enhance over the lifetime of the coverage. The Nationwide Affiliation of State Insurance coverage Commissioners has established rate-setting requirements and about half of the states, together with a number of of the big insurance coverage corporations, have adopted these measures.

Lengthy-term care insurance policies are “assured renewable,” which implies that they can’t be canceled or terminated due to the policyholder’s age, bodily situation or psychological well being. This assure ensures that your coverage will not expire until you have used up your advantages or have not made your premium funds.

Issues paying the premiums

When you cease paying your premium or drop your profit, a “nonforfeiture possibility” will permit you to obtain a decreased quantity of profit primarily based on the sum of money you have already paid. Some states require insurance policies to supply nonforfeiture advantages, together with profit choices with totally different premiums.

Since nonforfeiture provisions range by location, verify along with your state’s insurance coverage division or your state’s itemizing on the Nationwide State Well being Insurance coverage Help Program (SHIP)earlier than dropping your coverage. In case your coverage would not have a nonforfeiture possibility and also you cease paying the premiums, you may lose all the advantages for which you might have paid.

Coverage buying

When you’ve decided which long-term care insurance coverage choices finest meet your wants and also you’re prepared to purchase a coverage, do the next:

- Ask your state insurance coverage division for a listing of corporations authorized to promote long-term care insurance coverage insurance policies in your state. Discover out whether or not there have been complaints about any of the businesses that offered them.

- Test the soundness of the corporate and make sure it has an extended historical past with this sort of insurance coverage. You’ll be able to verify this info at web sites for corporations together with Moody’s Traders Service, Customary and Poor’s and A.M. Finest.

- Examine info and prices from a minimum of three main insurance coverage corporations. Learn the way typically and by how a lot the businesses have elevated their premiums.

- Get a written copy of any coverage you are contemplating. Assessment it rigorously, maybe with the help of your lawyer or monetary adviser. Write out your questions, and have a consultant of the insurance coverage firm reply to your questions in writing.

- By no means let anybody stress or scare you into making a fast choice.

- By no means pay any insurance coverage premium in money, and all the time make your verify payable to the corporate and never a person.

- Almost all states require insurance coverage corporations to provide you 30 days to assessment your signed coverage. Throughout this time, you’ll be able to return a coverage for a full refund for those who change your thoughts.

- Nonetheless have questions or considerations? Contact the company listed on your state on the State Well being Insurance coverage Help Program (SHIP).

Deciding whether or not long-term care insurance coverage is best for you can take a major period of time and analysis, however making the trouble might be time effectively spent.

The Best Age To Buy Long Term Care Insurance?

Long term care insurance cost California About one out of three shoppers who name the workplaces of the American Affiliation for Lengthy-Time period Care Insurance coverage are pissed off. They wish to purchase safety. They even met with an agent and utilized. However they have been turned down by the insurance coverage firm. They name searching for our assist – can they attraction – will one other insurer settle for them – why did this occur?

That is why we’re sharing the next details about the most effective age to use. So this does not occur to you.

Should you do not wish to learn the total clarification, we’ll inform you that for most individuals. the most effective age to use is in your mid-50s. . You may lock in your good well being and immediately there are insurance policies that will let you purchase some protection now and add to it in future years.

If you’re prepared to seek out out whether or not you possibly can “health-qualify” for long-term care insurance coverage (which means meet the insurance coverage firm necessities) and to see what protection prices begin the method. Click on right here to finish our easy on-line questionnaire and be related with a knowledgeable in your space there may be by no means any obligation and the data is free.

However let’s clarify why we consider the mid-50s is the best time to purchase long-term care insurance coverage. We’ll even provide you with an actual price instance under.

Most shoppers have no idea they need to “wellbeing qualify” for long-term care insurance coverage. There’s a saying, your cash pays for long-term care insurance coverage – however your wellbeing buys it. Your wellbeing is the one most essential issue. What does age should do with wellbeing?

Age And Your Capacity to Wellbeing Qualify for Lengthy-Time period Care Insurance coverage

As we age, our wellbeing modifications. And when you attain your 50s it virtually by no means will get higher (even if you happen to eating regimen and train). If you’re 50, likelihood is that you just go away your physician’s workplace with some new prescription in hand. That drug could aid you stay a protracted life. However it’s these modifications in our wellbeing that may make it tougher and even unattainable so that you can wellbeing qualify for long-term care insurance coverage.

- Listed here are some essential info to bear in mind

- Insurers supply reductions to candidates who’re in good well being

- These reductions are locked in. You don’t lose them in case you’re wellbeing modifications.

Every insurer establishes their very own wellbeing necessities. When you’ve got some circumstances or take some drugs (even widespread ones) it is best to communicate with a long-term care insurance coverage skilled. You could wish to request a quote .

Current wellbeing circumstances could also be acceptable (even if you happen to have been declined a number of years in the past.

The share of candidates who qualify for good wellbeing reductions declines as one ages (see the chart under)

The share of candidates who’re declined for wellbeing causes will increase as one ages (see the chart under)

Premiums for long-term care insurance coverage are based mostly in your age once you apply.

Prices improve in your birthday. The annual price will increase are typically 2-Four % in your 50s however begin to be 6 to eight % per-year in your 60s.

In 2009, new consumers of particular person long-term care insurance coverage have been the next ages: Underneath age 54 (26.5%). Between 55 and 64 (54%).

Newest Knowledge: Your Age Impacts Reductions And Declines

Your good well being may also help cut back the price of long-term care insurance coverage. Insurers supply reductions that you don’t lose even when your heaslth modifications.Right here is the proportion of candidates who qualify (American Affiliation for Lengthy-Time period Care Insurance coverage 2010 Sourcebook)

- Ages 40 to 49: 62.zero%

- Ages 50 to 59: 46.zero%

- Ages 60 to 69: 38.zero%

An present well being situation may cause you to be “rated” (which means you will pay extra). Or, you might not be capable of well being qualify in any respect.Right here is the proportion of candidates who we declined – they didn’t qualify for the insurance coverage they utilized for (American Affiliation for Lengthy-Time period Care Insurance coverage 2010 Sourcebook)

- Ages 50 to 59: 14.zero%

- Ages 60 to 69: 23.zero%

Let’s Look At A Actual Value Instance: Why Ready Would not Pay

Due to well being modifications that happen most frequently after individuals attain their 50s, we advocate that long-term care planning begin in your 50s. However there may be another excuse it would not pay to attend — and that is since you’ll pay extra.

Here’s a actual instance. The next situations use actual charges (2010).

You might be age 55. You need what we time period a “commonplace” plan of protection. That equals $172,600 in present advantages (based mostly on a $150 each day profit for a Three-year plan). Your price is $1,084 per yr since you qualify for the popular well being low cost (spousal low cost too).

Lengthy-term care insurance coverage safety ought to develop to maintain tempo with rising prices. The one we’re illustrating does. So, by age 65, the $172,600 profit you purchased at age 55 — may have grown in profit worth to $276,000.

Somebody age 65 (immediately) would pay $Three,275 for $276,000 in protection as a result of it is most unlikely they are going to nonetheless qualify for that good well being low cost.

And that displays immediately’s charges. Chances are high charges will rise. So, the 55 yr previous who waits for the 10 years can pay much more.

It virtually by no means pays to attend. And, there may be yet another essential level. If you are ready, you might be uninsured. If one thing occurs inflicting you to wish long-term care (reminiscent of an accident or an sickness), you will should pay your self. . And, whereas most individuals want long-term care of their 70s and 80s, some do want care of their 50s and 60s.

Long Term Care Insurance Cost Calculator

The webpage explains get one of the best long run care insurance coverage prices. Our purpose is offering essentially the most present and goal info that can assist you make smarter choices.

The American Affiliation for Lengthy-Time period Care Insurance coverage doesn’t promote insurance coverage. If you want info or precise value quotes from a number one professional licensed in your state full our easy questionnaire.

Your info will likely be shared with just one LTC insurance coverage specialist. It is not going to be bought or exchanged and you might be underneath no obligation (ever!).

Lengthy Time period Care Insurance coverage Charges for Single Age 55

Common Value: $2,007-per-year *

Low Value: $1,764

Excessive Value: $three,446

* Common Value (with most well-liked well being low cost): $1,720-per-year

Age 55, normal well being fee. Preliminary coverage profit for EACH is $164,000 based mostly on a Day by day advantage of $150 and three yr profit interval. Protection worth will improve yearly as a result of a three p.c compound inflation progress choice was included.

Lengthy Time period Care Insurance coverage Charges for Couple Each Age 55

Common Value: $2,466-per-year (mixed)

Low Value: $2,080

Excessive Value: $four,824

Each people are age 55, normal well being fee. Preliminary coverage profit for EACH is $164,000 based mostly on a Day by day advantage of $150 and three yr profit interval. Protection worth will improve yearly as a result of a three p.c compound inflation progress choice was included.

Lengthy Time period Care Insurance coverage Charges for Couple Each Age 60

Common Value: $three,381-per-year (mixed)

Low Value: $2,794

Excessive Value: $5,637

Each people are age 55, normal well being fee. Preliminary coverage profit for EACH is $164,000 based mostly on a Day by day advantage of $150 and three yr profit interval. Protection worth will improve yearly as a result of a three p.c compound inflation progress choice was included.

WHY do long run care charges range a lot?

Every insurance coverage firm units their very own fee and we’ve got discovered that every firm has a “candy spot”. Plus charges can change as insurance coverage corporations discontinue promoting a sure coverage and introduce a brand new policyfor sale in your state.

The Affiliation’s annual LTC insurance coverage Worth Index appears at 10-12 main insurance coverage corporations together with the AARP long run care insurance coverage plan and we discover that the corporate providing one of the best fee for a 55-year-old couple DOES NOT provide one of the best fee for a 65-year-old couple.

RECOMMENDATION Ask the insurance coverage agent or monetary consultant the next query: “What number of insurance coverage corporations are you APPOINTED to promote?”. Some are solely appointed (authorized) to promote insurance coverage from one firm; and naturally that’s the one they may strongly suggest. Most educated long run care insurance coverage specialists are appointed with 5 – 6 of the main long run care insurance coverage corporations Solely they may do a good analysis as a result of they’ll promote you any of those insurance policies.

Inquiries to get greatest long run care charges

We already defined why asking What number of insurance coverage corporations are your APPOINTED to promote?” is such an necessary questions. The Ford supplier goes to promote you a Ford as one of the best automotive. A Toyota supplier will inform you solely why their automotive is greatest. With long run care insurance coverage, you need an insurance coverage agent who retailers and compares for you when making a suggestion.

Ask what long run care insurance coverage reductions chances are you’ll qualify for. The Affiliation’s web site has some nice shopper guides that designate the assorted reductions obtainable.

When you have some present well-being points or take prescription drugs, ask whether or not these will likely be acceptable and do not merely settle for the remark, “we’ll let’s full the appliance and see!”. An educated long run care insurance coverage agent can have sense of what’s acceptable. Situations that can lead to you paying extra with one firm could also be acceptable (with no added value) from one other insurer.

Ask when the coverage was first authorized on the market in your state. A lot of the bigger, dedicated long run care insurance coverage corporation’s difficulty newer insurance policies each few years. An older coverage could also be high-quality but it surely may additionally used older pricing which implies you possibly can face potential bigger will increase down the street.

A ultimate suggestion gives you with a pleasant strategy to see what number of long run care insurance coverage insurance policies the agent you might be working with sells and the way lengthy they’ve been within the occupation. Ask have any of their shoppers filed a declare on their long run care insurance coverage coverage? It is a good manner of seeing if they only dabble- or whether or not they specialize. Likelihood is you will not learn your coverage till it’s important to file a declare. You need an insurance coverage skilled who has learn the assorted insurance policies she or he is representing to you.

Methods to get greatest long run care prices

Solely a long run care insurance coverage skilled can inform you whether or not you’ll be able to well being qualify for this safety – and examine present charges from a number of insurance coverage corporations to get you one of the best protection for the bottom value.

Whereas the American Affiliation for Lengthy-Time period Care Insurance coverage doesn’t promote insurance coverage we wish to assist. You’ll be able to name our workplace to get basic questions answered. The cellphone quantity is (818) 597-3227 from eight AM till four PM Pacific Time.

Or click on the field under and full our personal request for info kind. Your info will likely be shares WITH ONLY ONE long run care insurance coverage specialist appointed in your state and in a position to examine a number of insurance coverage insurance policies. You might be underneath no obligation and there’s no value.

4 Secrets to Buying Long-Term-Care Insurance

Most individuals fall someplace within the center: They’re keen to spend a specific amount of their private financial savings on long-term care but additionally may benefit from a extra restricted coverage and different methods to fill within the gaps.

- Assess your danger

To search out the correct coverage, first decide the kind of danger you are making an attempt to cowl. Think about your well-being, hereditary circumstances and longevity in your loved ones, availability of household caregivers, and private preferences.

If you wish to stay at residence and have relations who can present some care, for instance, you could wish to purchase a coverage with a comparatively low profit stage. With the nationwide median charge for a house well-being aide at $20 an hour, the coverage may present sufficient to cowl the price of an aide for two.5 hours a day to present family a break.

Too usually, Thau says, monetary advisers talk about solely larger profit ranges that might cowl the price of assisted residing or a nursing-home keep. “You may get a small coverage that may be wondrous” when it comes to permitting you to stay at residence without overburdening household caregivers, he says.

A coverage that might cowl a lot of the payments at a facility prices significantly extra. Glenworth, for instance, at the moment expenses a wholesome 55-year-old married couple greater than $6,700 a yr for a three-year coverage with a $150 every day profit and 5 p.c compound inflation safety. And right this moment, that coverage would cowl solely 60 p.c to 70 p.c of nursing-home prices — the nationwide median charge for a semi-private room is $220 a day, whereas a personal room prices $250 a day, in response to Glenworth.

You can use this richer profit to cowl residence wellbeing prices. However the $150 would cowl simply 7.5 hours a day for a house wellbeing aide.

To search out the price of residence care, grownup day wellbeing care, assisted-living amenities and nursing properties in your group.

- Reduce the price

As soon as you’ve got thought of the kind of danger you’d wish to cowl, ask yourself, “how a lot of that danger are you able to switch to the insurance coverage firm, and the way a lot are you able to tolerate by yourself?” Burns says. Step one is to decide on a deductible, also referred to as the “elimination interval,” which is the variety of days between the time you turn into eligible for advantages and the time the insurer begins paying.

Many insurance policies provide a 90-day elimination interval, however put together to spend $22,500 out of pocket for nursing-home care till advantages kick in. The longer your elimination interval, the decrease your premium will likely be. A 90-day elimination interval prices about 40 p.c lower than a zero-day deductible, says James Glickman, president of LifeCare Assurance, a long-term care reinsurer in Woodland Hills, Calif.

Selecting a shorter profit interval can even minimize your price. A profit interval of three to 5 years “will cowl the overwhelming majority” of long-term care wants, says Daybreak Helwig, a principal at actuarial and consulting agency Milliman. Shoppers “should not really feel like they’ve to purchase the Cadillac coverage,” she says.

One other method: Select a coverage with a “future buy possibility,” which has no computerized inflation adjustment, enables you to pay a decrease premium right this moment and provides you the choice of boosting protection down the highway. Such a coverage would price the 60-year-old couple above $2,239 a yr, in response to the affiliation.

“There is a decrease price getting into, and that permits some flexibility to handle inflation over time,” says Kamilah Williams-Kemp, vice-president of long-term care at Northwestern Mutual. However Burns warns that the future-purchase possibility might be “a harmful idea.” When including inflation changes in future years, “you are paying extra primarily based in your age, and sooner or later you worth your self out,” she says.

- Purchase early

Individuals who decide that they need a coverage have good purpose to purchase sooner somewhat than later — ideally whereas of their 50s. Premiums will climb with annually you age.

Shopping for whereas nonetheless in good well being has turn into extra necessary as insurers tighten underwriting requirements. Some firms have added blood-test necessities and began scrutinizing household well being historical past for circumstances reminiscent of coronary heart illness and dementia.

One-fourth of candidates age 60 to 69 are rejected, and 44 p.c of these age 70 to 79 are denied protection, in response to the American Affiliation for Lengthy-Time period Care Insurance coverage. Most firms will not problem insurance policies to individuals over 75, says Jesse Slome, government director.

Married ought to contemplate a “shared care” rider, which permits to share advantages. If a husband and spouse every have a three-year profit interval, for instance, and the spouse develops dementia and makes use of up three years of care, she will be able to dip into her husband’s advantages.

Single girls face main challenges within the long-term care insurance coverage market. As a result of girls stay longer than males, insurers lately have begun charging single girls larger premiums than single males — usually about 50 p.c extra. If potential, single girls excited about protection can buy it by way of an employer, as a result of unisex pricing continues to be obtainable within the employer market. You possibly can maintain the coverage once you go away your job.

four. Decide affordability

Premiums have been rising sharply lately as a result of many assumptions insurers made when pricing insurance policies in years previous turned out to be unsuitable. Fewer individuals have dropped these insurance policies than anticipated, and insurers have confronted extra claims than anticipated. On the similar time, a protracted interval of ultra-low rates of interest has left insurers with decrease funding earnings than they projected.

Some shoppers in search of to keep away from the chance of premium will increase have gravitated towards hybrid merchandise combining long-term care insurance coverage with life insurance coverage. You sometimes pay a single upfront premium for a cash-value life insurance coverage coverage that may pay advantages early for those who want long-term care or present your heirs a dying profit for those who do not want care.

However some advisers warn that this generally is a very expensive method of getting long-term care protection as a result of shoppers hand over the chance to get market development charges on a big lump sum of cash. When you put $200,000 right into a hybrid product and rates of interest go from right this moment’s near-zero ranges to six p.c, Kitces says, the product is definitely costing you $12,000 a yr — and “it is the costliest long-term care insurance coverage coverage within the historical past of long-term care insurance coverage.”

Forgoing protection will also be a expensive resolution, when it comes to high quality of life. Individuals who know they should cowl their very own long-term care prices typically will not spend cash on journey and different frills throughout retirement, Thau says. Those that select to self-insure could even be reluctant to get the care they want. “I’ve seen individuals fearful of working out of cash, in order that they by no means get the mandatory care,” Slome says.

Individuals who really feel strongly about getting the kind of care they need could discover long-term care protection effectively definitely worth the worth. Donna McCullough, 70, purchased a coverage at age 51 after her mom, who had damaged a hip and entered a facility for bodily remedy, was recognized with Parkinson’s. The proprietor of a paralegal firm in Columbia, S.C., McCullough determined that if she wanted care, she’d prefer it to be in a great assisted-living facility. She’s cautious of getting her decisions restricted by counting on Medicaid.

“I might somewhat have just a little freedom,” she says. And as a divorcee with no kids, “I do not actually wish to be cared for at residence,” McCullough says. “I am too social for that.”

Tips for Long term care insurance

- Purchase from a longtime nationwide firm with monetary energy. Bear in mind: You are shopping for a coverage chances are you’ll not want to make use of for a few years and also you need the insurer to stay round.

- Search for flexibility. Make sure that your coverage can pay for dwelling well being care, nursing dwelling care, and even respite care, which provides caregivers a break. Additionally be certain the coverage will cowl Alzheimer’s and different long-term cognitive problems

- Purchase the inflation rider. A payout of $100 a day could be value solely $76 a day after 10 years of three% annual inflation.

- Store round. Insurers have the fitting to alter premiums. Do not simply search for the bottom preliminary premiums. Insurers with low costs now would possibly increase charges later.

- Do you have to purchase long-term care insurance coverage? It relies upon. The chances of spending a few years in a nursing dwelling are pretty low in the event you’re in good well being and haven’t any household historical past of Alzheimer’s or stroke. However in the event you worry being a burden to your loved ones, or in the event you do not need to wind up in a nursing dwelling paid for by Medicaid, you would possibly take into account a long-term care coverage.

- There is no sense in shopping for long-term care insurance coverage in the event you’re behind on paying your payments or funding your retirement.

Not less than half of the inhabitants 85+ will need assistance with among the actions of every day residing. Such care is offered when somebody can now not independently perform important on a regular basis actions like consuming, bathing, dressing, and so forth. Most individuals consider long-term care as one thing wanted by older individuals, however accident or sickness can strike somebody of any age. When it does, they too could discover themselves in want of help.

Historically, girls in U.S. households have offered this care when wanted. Nonetheless, as we speak’s smaller households could also be scattered throughout the nation, and many ladies are actually working exterior the house. What’s extra, caring for a cherished one full-time can overwhelm even probably the most devoted member of the family. Because of this, extra caregivers than ever are turning to exterior sources to assist with the care of a member of the family.

Many individuals mechanically consider nursing houses once they consider long-term care, however there are different choices obtainable as nicely, some offered in your individual dwelling or others locally.

Do retirees want long-term care insurance coverage?

Well being care prices are a giant concern for individuals going into retirement, however the prices of long-term care can nonetheless be a shock.

Listed here are a number of information:

- 70% of individuals over 65 will want some type of long-term care sooner or later. Statistics present that a minimum of 6.four million individuals aged 65 or older as we speak will want long-term care inside one or two years after turning 85.

- For married , the prospect that one partner will want long-term care rises to 91%,

- Individuals residing alone usually tend to want some form of dwelling well being care.

- Girls outlive males, and thus, usually tend to reside alone and wish some form of dwelling well being care.

So, whereas some monetary planners beforehand had been on the fence about buying long-term care insurance coverage, most had been nonetheless encouraging individuals to a minimum of have a plan for long-term care.

Since long-term care insurance coverage offers the aged or infirm with the chance to remain of their houses, this is a crucial issue within the choice course of. If that is the place the insured needs to be, versus a facility like a nursing dwelling, long run care might be the fitting selection.

A number of issues had been working towards the broad enchantment of long-term-care insurance coverage over time. A serious downside is the expense. The insurance coverage trade has seen some dramatic charge will increase up to now a number of years on account of new medicine and higher care to increase lives. Because of this a number of insurance coverage suppliers received out of the enterprise totally because it turned much less worthwhile.

- Long Term Care Insurance Rates Cost Comparison from leading long

- cost of long term care insurance for 65 year old

- average cost of long term care insurance at age 60

- long term care insurance quote

- how much is insurance for nursing home?