Liquidity Ratios

Liquidity Ratios examine the capability of a company to repay both its current liabilities as they become due along with their long-term liabilities as they become current.

In other words, Liquidity Ratios measure how quickly assets can be turned into cash in order to pay the company’s short-term debts.

Liquidity is not only a measure of how much cash a business has. It is also a measure of how easy it will be for the company to raise enough cash or convert assets into cash. Assets like accounts receivable, trading securities, and inventory are relatively easy for many companies to convert into cash in the short term. Thus, all of these assets go into the liquidity calculation of a company.

Usually, the higher the liquidity ratios are, the higher the margin of safety that the company possesses to meet its current liabilities.

If Liquidity ratios greater than 1 it show that the business is in good financial health and it is not as much of expected to drop into financial problems.

Examples of Liquidity Ratios

- Quick Ratio

- Acid Test Ratio

- Current Ratio

- Working Capital Ratio

- Times Interest Earned Ratio

It is noted that some experts think only the cash and cash equivalents as relevant assets because they are probably to be used to meet short-term liabilities in a crisis.

Some experts think the debtors and account receivables as related assets as well as cash and cash equivalents. Some experts considered the value of stock/inventory is also related asset for calculations of liquidity ratios.

You may also like to read

Here are the types of liquidity ratios.

-

Quick Ratio

The quick ratio is also called acid test ratio. It is a liquidity ratio that measures the capability of a business for payment of its current liabilities with only current assets when they come due.

Current assets are also called Quick assets that can be converted into cash within 3 months/90 days or in the immediate. Cash, cash equivalents, short-term investments or marketable securities and current accounts receivable are considered current assets.

The quick ratio is often called the acid test ratio in reference to the historical use of acid to test metals for gold by the early miners. If the metal passed the acid test, it was pure gold. If metal failed the acid test by corroding from the acid, it was a base metal and of no value.

The acid test of finance indications how well a business can quickly convert its assets into cash with the purpose of repaying its current liabilities. Acid test ratio also shows the level of quick assets to current liabilities.

The Formula of Quick Ratio:

An Example of Quick Ratio:

I have take-up an example of TOYO Co Shoes Store. The company applied for the loan so the bank requests TOYO Co for a comprehensive balance sheet, so it can calculate the quick ratio. TOYO Co balance sheet involved the following accounts:

- Cash: $20,000

- Accounts Receivable: $10,000

- Inventory: $12,000

- Short-term Investments: $2,000

- Current Liabilities: $30,000

Quick Ratio = Cash + Cash Equivalent + Short Term Investment + Current Receivable

Current Liabilities

Quick Ratio = 20000+10000+10000+2000

30000

Quick Ratio = 1.4

As you can see TOYO’s quick ratio is 1.4. This means that TOYO can settle all of her current liabilities with quick assets and still have some quick assets available.

Scrutiny/Analysis of the Current Ratio:

Higher quick ratios are more favorable for businesses because of it indications there are more quick assets than current liabilities. A business with a quick ratio of 1 indicates that quick assets equal current assets. It is also indications that the business could repay its current liabilities without selling any durable assets. An acid ratio of 2 shows that the business has double current assets than current liabilities.

The Higher quick ratio is a good sign for investors, but an even better sign to creditors because creditors want to know they will be paid back on time.

-

Current Ratio:

The current ratio is a liquidity that calculates a firm’s capability to pay back its short-term liabilities with its current assets. The short-term liabilities are due within the next year so current ratio is a vital measure of liquidity,

Current assets are those which can easily be converted into cash in short term, for example, cash, cash equivalents, and marketable securities

Businesses with more amounts of current assets will easily be able to pay back current liabilities when they become due deprived of having to sell off long-term, revenue making assets.

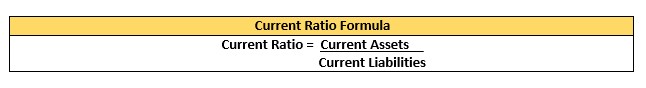

Current Ratio Formula:

The current ratio formula is very simple it is calculated by dividing current assets by current liabilities. This ratio is stated in numeric format instead of in decimal format.

Current Ratio Example:

Current Ratio = Current Assets__

Current Liabilities

Current Ratio = 800,000

400,000

Current Ratio = 2:1

Noticeably a larger current ratio is better than a smaller ratio because it shows the company can more easily make payments of current debt. Some individuals feel that a current ratio that is less than 1:1 indicates insolvency.

Scrutiny/Analysis of the Current Ratio:

The current ratio assists stockholders and creditors to know the liquidity of a company. It shows how a company will be able to pay back its current liabilities without any difficulty.

Consequently, a current ratio of 2 would mean that the company has 2 times more current assets than current liabilities.

If a company has to pay its current liabilities by selling of fixed assets, this means the company isn’t generating sufficient revenue from operations to support activities. We can say, the company is losing money. Sometimes this is the result of poor collections of accounts receivable.

-

Working Capital Ratio:

The working capital ratio, also known as the current ratio, is a liquidity ratio that measures business’s ability to repay its current liabilities with current assets. The working capital ratio is vital to creditors since it shows the liquidity of the company.

Current liabilities are finest paid with current assets like cash, cash equivalents, and marketable securities because these assets can be converted into cash much quicker than fixed assets. The faster the assets can be converted into cash, the more likely the company will have the cash in time for the payments of its debts.

Formula of Working Capital Ratio

The Working Capital ratio formula is very simple it is calculated by dividing current assets by current liabilities. This ratio is indicated in numeric format instead of in decimal format.

Working Capital Ratio Example:

Current Ratio = Current Assets__

Current Liabilities

Current Ratio = 500,000

900,000

Current Ratio = 0.5

From the above illustration, TOYO’s Working Capital Ratio is less than 1 it means that the business debt is growing. This makes TOYO Co more risky to new possible credits. If TOYO Co wants to apply for another loan then they should repay some of the liabilities to lower their working capital ratio before they apply.

Scrutiny/Analysis of the Working Capital Ratio:

A higher ratio of WCR is more favorable.

A Working Capital Ratio of 1 indicates the current assets equal current liabilities. A ratio of 1 is usually considered the center. It’s not dangerous, but it is also not very safe. It means that in order to repay its current liabilities the firm would have to sell all of its current assets.

Creditors and investors considered ratio less than 1 are risky because of it indications the company isn’t running proficiently and can’t cover its current debt correctly. A ratio less than 1 is always a bad and is often mentioned to as negative working capital.

A ratio above 1 indications outsiders that the company can pay all of its current liabilities and still have current assets left over or positive working capital.

-

Times Interest Earned Ratio (TIE)

The time’s interest earned ratio, occasionally called the interest coverage ratio, is a coverage ratio that measures company’s ability to meet the interest payments on its debt.

Formula of Times Interest Earned Ratio (TIE)

Example of Times Interest Earned Ratio (TIE)

TOYO Co is a Shoe company that is currently applying for a loan to buy tools. The bank asks TOYO for his Income Statement & Balance Sheet before they will study his loan request. TOYO Co income statement shows that he made $700,000 of income before interest expense and income taxes. TOYO’s total interest expense for the year was only $70,000 TOYO’s TIE ratio would be calculated in this way:

TIE Ratio = Income before Interest and Taxes or EBIT

Interest Expense

TIE Ratio = 700000

70000

TIE Ratio = 10

TOYO’s has a ratio of ten. This means that TOYO’s income is 10 times greater than his annual interest expense. It means TOYO can afford to pay extra interest expenses. In this respect, TOYO’s business is less risky and the bank should easily accept his loan.

Scrutiny/Analysis of Time Interest Earned Ratio:

The time’s interest ratio is indicated in numbers. The ratio indicates how many times a company could pay the interest with it’s before tax income. The larger ratios are considered more favorable the smaller ratios considerably less favorable.

The ratio of 4 means that a company’s income is 4 times higher than its interest expense for the year.

Creditors would favor a company with a much higher time’s interest ratio because it shows the company can afford to pay its interest payments when they come due. Higher ratios are less risky while lower ratios indicate credit risk.

If you want to learn more about Liquidity Ratio you can Visit.