Job Order Costing:

Job order costing is a cost accounting system in which direct costs are traced and indirect costs are allocated to unique and distinct jobs instead of departments. It is appropriate for businesses that provide non-uniform customized products and services.

Job order costing is one of the two main cost accounting systems, the other being the process costing in which costs are traced and allocated first to different processes carried out in different departments and then to products and services. Many companies use costing systems that are a blend of features of both job-order costing and process costing systems.

Job Order Costing used by companies

Some of the companies that use Job Order Costing include:

1. Accounting, consulting and legal firms

2. Architects

3. Manufacturers of ships and airplanes

4. Book publishers

5. Movie producers

The nature of their work is such that they are interested in finding profitability of different jobs and hence they accumulate costs with reference to different jobs like audit engagement, consulting projects, books, movies, etc.

You may also like to Read:

Job order Costing Example:

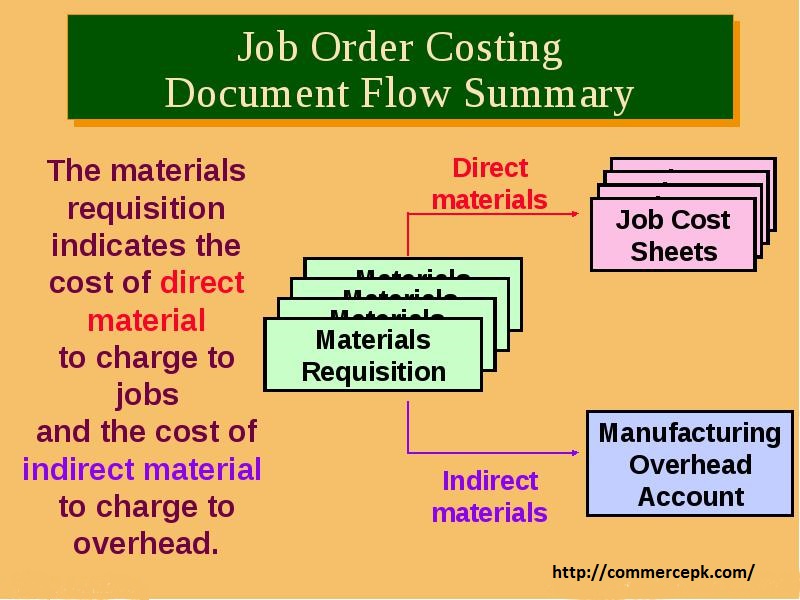

In a job order costing system, jobs are accounted for using the job-order cost sheet. The process involves the following steps:

- Identification of the job

- Tracing direct costs to the job

- Identifying the indirect costs i.e. manufacturing overheads and finding the cost allocation base for each cost.

- Applying the indirect costs to the job using the pre-determined allocation rate.

Finding total cost by summing up all the cost components.

Closing the under/over-applied manufacturing overheads to cost of goods sold/income statement.

Calculating revenue and profit.

Job Order Casting: Example: Journal Entries

Dynamic Systems Inc. (DS) received an order to manufacture a customized airplane for the official use of the president of Pakistan. DS will charge an amount equal to the cost of the airplane plus a 30% profit margin on cost to the government of Pakistan. The job code is FF04

Since the manufacture of the airplane is a one-off project, job-order costing is the most appropriate cost accumulation system. Let us post the required journal entries in the DS costing system.

- DS purchased raw materials (such as aluminum, fiber, etc.) at a cost of Rs.4 million.

Material inventory Rs.4,000,000

Material inventory Rs.4,000,000

Accounts payable Rs.4,000,000

- $2.8 million worth of raw materials were used in the project as direct materials.

Work in process—FF04 Rs.2,800,000

Inventories Rs.2,800,000

3. Rs.0.4 million worth of raw materials were used as indirect materials.

Manufacturing overheads Rs400,000

Inventories Rs.400,000

4.Total direct labor hours consumed on the job cost Rs.3 million. The amount is already paid.

Work in process—ff04 Rs.3,000,000

Cash Rs.3,000,000

5.Indirect labor hours relevant to the project cost

$1 million. Manufacturing overheads Rs.1,000,000

Cash Rs.1,000,000

6.Other indirect costs yet to be paid were Rs.2.5 million.

Manufacturing overheads Rs.2,500,000

Accounts payable Rs.2,500,000

7.Manufacturing overheads are charged to jobs at 100% of direct labor cost i.e. Rs.3,000,000.

Work in process—FF04 Rs3,000,000

Manufacturing overheads Rs.3,000,000

8.The cost of FF04 is transferred from work in progress to finished goods on its completion at total cost of Rs.8,800,000 (=direct materials cost of Rs.2,800,000 plus direct labor cost of Rs.3,000,000 and applied manufacturing overheads of Rs.3,000,000).

Finished goods Rs.8,800,000

Work in process—FF04 Rs.8,800,000

9. Revenue is recorded at Rs.11,440,000 [= Rs.8,800,000 × 1.3].

Accounts receivable Rs.11,440,000

Revenue Rs.11,440,000

10.Actual manufacturing overheads are $3,900,000 (=indirect materials of $400,000 plus indirect labor of $1,000,000 and other overheads of $2,500,000). Applied manufacturing overheads are $3,000,000. The $900,000 worth of manufacturing overheads under-applied is taken to the cost of goods sold or income statement.

Cost of goods sold Rs.900,000

Manufacturing overheads Rs.900,000

Profit on FF04 is Rs.1,700,000 (=revenue of Rs.11,440,000 minus finished goods of Rs.8,800,000 and under-applied overheads adjustment of Rs.900,000).