Final Accounts of Company

Final Accounts of company includes the Trading, Profit Loss and Balance Sheet.

This practical example of Final Accounts of company will show you that how we prepare the final accounts i.e. Trading, profit and loss account and Balance sheet of Business.

By Considering this example you will understand the basic theme of final account. In preparation of final accounts we prepare trading account to find out gross profit after that we prepare profit and loss account to ascertain the net profit of a business and finally we prepare balance sheet to check the financial position of a business.

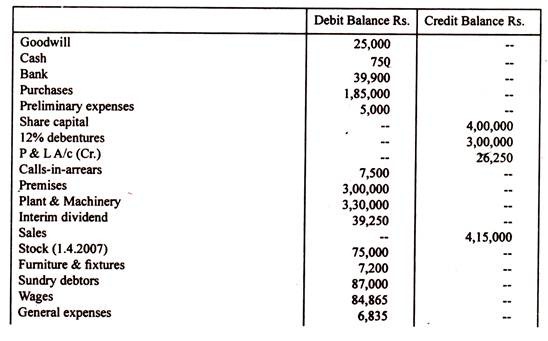

Example:

The balances are extracted from the books of Usman & Co on 31, December 2013.

The values in Rupees.

| Purchases | 3,900 | Capital | 17,900 |

| Wages | 2,800 | Sales | 60,000 |

| Stock on ist JanuaryBill receivableInsuranceSundry debtors

Carriage inwards Commission (Dr.) Interest on capital Stationery Returns inwards |

11,000

45,000 700 30,000 800 800 700 450 1,300 |

Returns outwards

Trade expenses Office fixtures Cash in hand Cash at bank Rent and taxes Carriage outwards Bills payable Creditors Closing stock |

500

200 1,000 500 4,750 1,100 1,450 3,000 17,900 25,000 |

Solution:

Usman & Co

Trading A/c

For the year Ended:

31, December 2013,

| To opening stockTo purchases 39,000-)less returns 500

To carriage inward To wages

To Gross profit Transfer to profit and loss a/c

|

11,00038,500

800 2,800

30,600 |

By sales 60,000-) Less sales returns 1,300By closing stock

|

58,70025,000 |

| Total | 83,700 | Total | 83,700 |

Usman & Co

Profit & loss A/c

For the year Ended:

31, December 2013,

| To SalariesRent & ratesCarriage outwardInsurance

Trade expenses Commission Interest on capital

To Net profit (transferred to balance sheet)

|

4501,1001,450700

200 800 700

25,200 |

By Gross profit

|

30,600 |

| Total | 30,600 | Total | 30,600 |

Usman & Co

Balance Sheet

As on 31, December, 2013

| Liabilities | Rs. | Assets | Rs. |

| Authorized Capital: Issued capital 17900+) Net profit 25,200

Liabilities: Fixed Liabilities: Long term Loans Debentures Total Fixed Liabilities

Current Liabilities: Creditors Bills Payables Bank Overdraft

|

43,100

—- —-

19,650 3,000

|

Fixed Assets: FurnitureBuildingPlant & machinery

Land Total Fixed Assets

Current Assets: Cash in hand Cash at bank Debtors Investment Bill receivable Closing Stock Office Fixture |

—- —- —- —-

500 4,750 30,000

4,500 25,000 1,000 |

| Total | 65,750 | Total | 65,750 |

You may like to Read: