Common Types of Partnership:

If you are looking for, Types of Partnership then this is your perfect target.

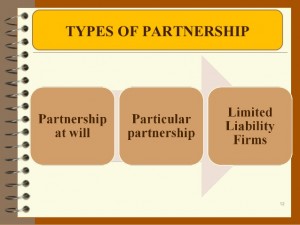

Types of Partnership

Partnership types may be divided into three categories:

- General partnership

- Limited partnerships

- Limited Liability Partnerships (LLP)

(1) General Partnership:

The liability of partners is unlimited in general partnership. This means that the creditor of the firm can realise his duties in full from any one of the partners or collectively by attaching their personal property. All the partners personally and collectively are liable for the obligations of the firm. All partners have equal rights and all of them can participate in management.

General partnership is the following kinds:

(a) Partnership at Will:

This type of partnership continues up to the time partners have faith in each other. It is dissolved when all partners want dissolution or any of the partner’s given notice for dissolution of the firm. The duration of the firm is not fixed beforehand.

the partnership at will continues upto the time, the partners have faith in each other. such a partnership is formed to carry on a lawful business for an indefinite period. a firm can be dissolved by a partner by giving notice in writing to his fellow partners. the partnership will stand dissolved from the date of such notice.

(b) Particular Partnership:

If a partnership is established for a definite work or a definite period, it is known as a particular partnership. when the work is completed or the period specified expires, the partnership comes to an end. An example of particular partnership is a partnership is formed for a limited period of 4 years , the firm would stand dissolved.

It is of two kinds:

(1) Fixed Work Partnership:

This type of partnership is started to complete a fixed work. After the completion of work the partnership dissolves.

(2) Fixed Term Partnership:

This type of partnership is established for a definite period. The partnership dissolves with the termination of the period.

you may also like to Read:

(2) Limited Partnership :

If in a partnership, the liability of one or more partners is limited to the amount of capital invested by them, it is known as a limited partnership. In such a firm at least one partner must have unlimited liability. So in a limited partnership, the liability of some partners is limited while the liability of some partners is unlimited. The partners with limited liability are called special partners and they cannot participate in management. They can make suggestions only.

(3) Limited Liability Partnerships (LLP):

Limited liability partnerships (LLP) recollect the tax rewards of the general partnership form but offer some personal liability protection to the participants. Single partners in a limited liability partnership are not personally responsible for the illegal acts of other partners, or for the debts or responsibilities of the business. Because the LLP form changes some of the essential parts of the traditional partnership, some state tax specialists may subject a limited liability partnership to non-partnership tax rules.

Present partnerships that request to take advantage of LLP status do not need to change their existing partnership agreement, however, they may choose to do so. In order to change status, a partnership simply files an application for registering as a limited liability partnership with the suitable agency. All countries require disclosure of the partnership’s name and principle place of business. Some countries also require, among other things, identification of the number of partners, a brief description of the business, a statement that the partnership will maintain insurance, and written acknowledgment that the limited liability status may expire.

If you want to learn more about Types of Partnership you can Visit