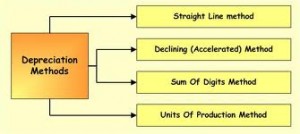

Depreciation Methods :

Depreciation method is use to calculate depreciation of assets.In this article, i will show you that how we calculate depreciation by using different methods, the following methods are use to calculate deprecation.

These depreciation methods with examples are as follow.

- Straight line or fixed installment method.

- Units of output method.

- Declining balance method.

- Sum of year digits method.

1.Straight line or fixed installment method of Depreciation;

This is the simplest and most widely used depreciation methods for computing the depreciation of an asset.it is also called as fixed installment method. This method is very useful when usage of an asset is fairly uniform from year to year.

Under this method the residual or scrap value of the asset is deducted from the cost and divided by the number of year of useful life. The resultant is the annual depreciation expenses, which are charged to every year’s profit.

The annual depreciation is calculated as under:

You may also like to Read:

- what is Depreciation

- Financial Accounting

Annual depreciation = cost – residual value/ year of useful life.

Suppose if the cost of a motor is rs.20, 000 its useful life is 4 years and scrap value is Rs.2000, the annual depreciation will be (20,000- 2000)= 18,000 divided by 4 = Rs.4500.

The fixed amount is charged to every year’s profit as depreciation and no consideration will be given to the volume of use or productivity of asset concerned.

Example:

On Ist January 2014 a motor car purchased worth Rs.20,000

Estimated life: 4 years

Scrap value: Rs.2000

Find the amount of depreciation under straight line method.

Solution:

Cost of motor Rs.20, 000

-) scrap value Rs.2000

Depreciable value Rs.18, 000

Estimated life 4 years

Annual depreciation =(18000/4) Rs.4,500

Depreciation schedule of the motor car

|

Year |

Cost of motor car |

Annual depreciation |

Accumulated depreciation |

Book value of the motor car |

|

2013 2014 2015 2016

|

20,000 20,000 20,000 20,000

|

4,500 4,500 4,500 4,500

|

4,500 9,000 13,500 18,000 |

15,500 11,000 6,500 2,000 |

2. Units of output method of Depreciation:

This is also called as production method. Under this depreciation methods the depreciation is calculated on the basis of use or productivity of the asset. If the asset is used more or gave more production in any year more depreciation will charged and if the use or production is less in any year less depreciation will be charged. The method is advocated on the ground group that the war and tear of the assets like motor vehicles and many other types of machinery depends upon its use and not merely the passage of time.

However this method is not suitable in all types of assets under this depreciation method the use of asset is based on working hour, production units mileage convered or period spend etc

The method is calculated as under:

Annual depreciation = cost- scrap value / estimated units of output

Example:

Car purchased on ist January 2013: Rs.400,000

Estimated working life: 200,000

Scrap value: Rs.100,000

The car covers 40,000 kilometer in 2013,

50,000 k.m in 2014, 35,000 k.m in 2015

32,000k.m in 2016, 43,000k.m in 2017

Calculate rate of depreciation per kilometer of a car.

Solution:

Calculation of per year kilometer depreciation rate.

Cost of car Rs. 400,000

-)Scrap value Rs. 100,000

Depreciation value Rs. 300,000

Estimated working life 200,000 km

Depreciation rate (30,000 divided by 200,000) Rs. 1.50 per km

Schedule of annual depreciation

|

year |

Cost |

Kilometer |

Rate per km |

Depreciation expenses |

Accumulated depreciation |

Book value |

|

2013 2014 2015 2016 2017 |

400,000 400,000 400,000 400,000 400,000 |

40,000 50,000 35,000 32,000 53,000 |

Rs.1.50 Rs. 1.50 Rs. 1.50 Rs. 1.50 Rs. 1.50 |

60,000 75,000 52,500 48,000 64,500 |

60,000 135,000 187,000 235,000 3000,000 |

340,000 265,000 213,000 165,000 100,000 |

3. Declining Balance Method of Depreciation:

This depreciation methods associates the high amount of depreciation expense in the initial year when the asset is new and its capacity is more and low in the later year. When the asset is older and capacity is less.

This depreciation methods is based on the assumption that the efficiency and output of the asset is usually higher in the initial years and its repair cost is lower as compared to the period when it becomes older under this method the rate of depreciation is charged on the declining balance instead of original cost. The yearly rate of depreciation is calculated as under.

R= rate of depreciation

N= estimated life

S= residual value/scrap value

C= original cost

Example:

Suppose on ist January 2013 the cost of an asset is Rs.1000,000 was purchased ,useful life is 3year and residual value is Rs.64,000.

The yearly depreciation will be calculated as under:

Solution:

R=1- [s/c]1/n

R=1- [64,000/1000,000]1/3

R=1- 40/100

R=6/100 or 60%

Schedule of depreciation of the machine

| Year | Cost of machine | Rate of deprecation | Amount if depreciation | Accumulated depreciation | Book value |

| 2013

2014 2015 |

1000,000

1000,000 1000,000 |

60%

60% 60% |

600,000

240,000 96,000 |

600,000

840,000 936,000 |

400,000

160,000 64,000 |

4. Sum of year digits method of Depreciation:

This depreciation methods also called allocates the large portion of the depreciation of the asset in the earlier years of it use. Under this method the years of useful life of the asset are added, their sum become the denominator of the series and the number of years its numerator which are applied against the depreciation cost of the asset,

For instants, estimated life of the asset is 4years .the sum of the years digits will be 1+2+3+4=10 this will be denominator and 1,2,3 and 4 will be numerator .

This rate of depreciation will be applied in reverse order i.e, 4/10 for 1st year and 3/10 for 2nd year,2/10 for 3rd year and 1/10 for 4th year.

Example:

Motor car worth: Rs.50, 000

Useful life = 5 years

Residual value= Rs.5, 000

Solution:

Calculation of depreciation rates

Cost of assets Rs.50, 000

Residual value (5,000)

Depreciable value 45,000

Useful life of the asset 5 years

Sum of the year’s digits 1+2+3+4+5= 15years

Series of rates: 1st year=5/15 2st year=4/15 3st year=3/15

4st year=2/15 5st year=1/15

| Year | Cost of Motor | Rate of deprecation | Depreciation Expense | Accumulated depreciation | Book value |

|

1 2 3 4 5 |

50,000

50,000 50,000 50,000 50,000 |

5/15 4/15 3/15 2/15 1/15 |

15,000

12,000 9,000 6,000 3,000 |

15,000

27,000 36,000 42,000 45,000 |

35,000

23,000 14,000 8,000 5,000 |