Debit Credit Rules in Accounting

In Financial Accounting Debit and Credit rules or principles of debit and credit, are used to complete double entry effect in the books of accounts,the basic principles which are used to complete transaction are explained as under;

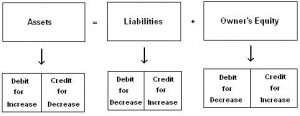

The account has two parties i.e Debit(Dr.) or left hand side and Credit (Cr.) or right hand side. When we write an amount on left hand side it is called as debiting an account and when we write an amount on the right hand side,it is called as crediting an account.

The following Debit and Credit rules will help us in determining the account to be debiting and crediting in given transaction.

| DEBIT FOR | CREDIT FOR |

| 1.Increase in Assets. | 1.Decrease in Assets. |

| 2.Decrease in Liabilities. | 2. Increase in Liabilities. |

| 3.Decrease in Capital/Owner equity. | 3.Increase in Capital/Owner equity. |

| 4.Decrease in Income. | 4.Increase in Income. |

| 5.Increase in Expense. | 5.decrease in Expense. |

You may also read basic terms used in Accounting.