Why we Prepared Bank Reconciliation Statement

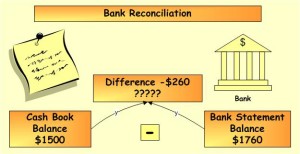

Why we reconcile bank statement because balance shown by the bank statement must agree with balance as shown by the cash book. But sometimes it does not agree. The cause of disagreement is as under: for this purpose we prepare bank reconciliation statement and reconciling the bank balance.

The following point are describe to clear the concept that why we reconcile bank statement.

You may also read to understand Well:

- What is Bank Reconciliation Statement

- Bank Reconciliation Statement.

- Debit and Credit Rules, Cash Book

1.Unpresented Cheques:

Those cheques drawn by the depositors and are recorded in his books but not presented for payment to the bank as such these cheques are not debited in the book, or deducted from the bank statement for the period due to which the balance shown by the bank statement is overstated.

2.Uncollected cheques:

when the cheque is deposited in the bank, it recorded in the cash book on the same day. These cheques are entered in the depositor’s account only when they are collected by the bank. The collection takes sometimes the discrepancy arises by which bank balance as shown by the bank statement is understated.

3.Dishonored cheques:

The cheques deposited by the customers may be dishonored. The information for such dishonor may not have been received by the customer, and as such the balance shown by his own record is overstated.

4.Deposit in trains:

It is possible that cash sent to bank at the late hours and recorded in the cash book on the same day may not be recorded in the bank statement prepared and sent on that day. Due to this the balance as shown by the bank statement is understated.

5.Service charges:

The bank usually debits the customer’s account for the service charges for collection of cheques, drafts etc these service charges are entered by the customer in cash book/ Cash payment journal when the intimation is received. Until and un less they are recorded in cash book the balance of and as shown by cash book will be overstated.

6.Miscellaneous charges and Incomes:

Sometimes, bank deducts trade expenses, interest on overdraft etc similarly additions are made in the bank statement for interest given to the customer or any other income. The entry for these sundry transactions is made in the depositor’s books when intimation is received by him as such the balance may disagree.

Besides the above reasons, there may be mistakes or errors in the bank statement or in the depositor’s record, which shows result into disagreement of both balances.