Assets and Liabilities are the main head of Accounting.

Assets and Liabilities

Assets :

Are economic resources that are owned by a business and are expected to benefit future operations. In most cases, the benefit to future operations comes in the form of positive future cash flows. The positive future cash flows may come directly as the asset is converted into cash (collection of a

receivables) or indirectly as the asset is used in operating the business to create other assets that result in positive future cash flows (building & land used to manufacture a product for sale). Assets may have definite physical form such as building, machinery or stock. On the other hand, some assets exist not in physical or tangible form, but in the form of valuable legal claims or right.

Examples are accounts

receivables, investment in govt. bonds and patent rights etc.

Liabilities

Are debts and obligations of the business. The person or organization to which the debt is owed is called creditors. All businesses have liabilities; even the most successful companies’ purchase stocks, supplies and receive services on credit. The liabilities arising from such purchases are called Accounts payable.

Rule of Debit and Credit for Assets and Liabilities:

Assets (increase in assets is debit and decrease in asset is credit)

Liabilities (Increase in liability is credit and decrease in liability is debit)

You May also like to Read

Basic Accounting Terms

What is Accounting Equation

Classification of Assets:

There are two types of assets:

1. Tangible Assets which have physical existence and can be seen or touched. It includes Fixed as well as Current assets.

2. Intangible assets which have no physical existence like goodwill, patents and copyrights etc.

• Fixed Assets – Are the assets of permanent nature that a business acquires, such as plant, machinery, building, furniture, vehicles etc. Fixed assets are subject to depreciation.

• Long Term Assets –These are the assets of the business that are receivable after twelve months of the balance sheet date. For example, if business has invested some money for two years in any saving scheme or has purchased saving certificates for more than one year, it is a

long term asset.

• Current Assets – Are the receivables that are expected to be received within one year of the

balance sheet date. Debtors, closing stock & all accrued incomes are the examples of Current Assets because these are expected to be received within one accounting period from the balance sheet date.

The year, in which long term asset is expected to be received, long term asset is transferred to current assets in that year.

Classification of Liabilities:

Capital:

Is the funds invested by the owners of the business. Business has a liability to return these funds to the owner. We know that for the purpose of accounting, business is treated separately from its owners. This is known as Separate Entity Concept i.e. Business is a separate entity.Therefore, if the owner gives something (can be in form of Cash or Some other Asset) to the business then the business, not only has to return the amount to the owner but it also has to give some return on that money. That is

why we treat Capital (Owners Funds) as a Liability.

Profit & Loss Account :

The net balance of the profit and loss account i.e. either profit or loss also belongs to the owners. While explaining capital we said that the business has to give return to the owners. Now if the business is

managed successfully, then this return would be a Favorable figure (Profit). This return will, therefore, be added to the Owners investment.

On the other hand, if the business is not managed successfully then this return would be an un-favorable figure (Loss). It will, therefore, be deducted from the Owners’ Investment.

• Long Term Liabilities – These are the liabilities that will become payable after a period of more than one year of the balance sheet date. For example, if business has taken a loan from bank or any third person and it is payable after ten years, it will be treated as a long term liability for the business.

• Current Liabilities – These are the obligations of the business that are payable within twelve months of the balance sheet date. Creditors and all accrued expenses are the examples of current liabilities of the business because business is expected to pay these back within one

accounting period.

The year in which long term liability is to be paid back, long term liability is transferred to current liability in that year.

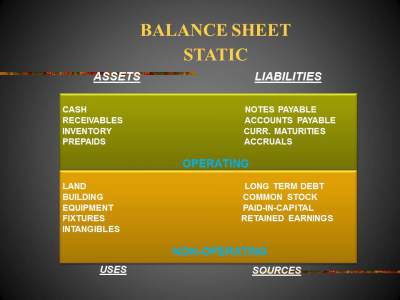

Balance Sheet:

It is a position statement that shows the standing of the organization in Monetary Terms at a Specific Time. Unlike Profit and Loss that shows the performance of the entity over a period of time, the Balance Sheet shows the Financial State of Affairs of the entity at a given date. Balance sheet is the summarized analysis in a T form of all assets and liabilities of the entity, with liabilities listed on left hand side and assets on right hand side. Asset is any owned physical object (tangible asset) or a right (intangible asset) having economic value to the owner. Liability is an obligation of the business to deliver goods or to provide a benefit in future.