Advantages and Disadvantages of Partnership

Partnership firm is an association of persons who have agreed to carry on business with a view to make profit. The advantages of partnership firm are given below:

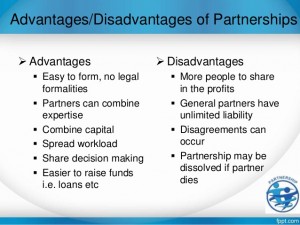

Advantages of Partnership

Easy to form and Dissolve: A simple agreement among partners is sufficient to register a partnership. No other formal documents and legal formalities are required. It is equally easy and inexpensive to dissolve a partnership.

More Resources: Partnership is a combination of several persons. So more capitals can be collected and advantages of large scale business may be obtained. More partners can be added if capital needs are large.

Coordination of Different Abilities: In partnership firm, there is a harmonization of different abilities of different partners. The talent, expertise and knowledge of partners in different fields can be used for the welfare of the business. So, there is more chance for the advancement of business.

Credit Facility: The ability of partners being unlimited they will be able to borrow more capital. As compared to sole trading concern, partnership has more credit worthiness. More securities can be provided by a partnership firm to the finance institutions and other creditors.

You may also like to Read:

Appropriate Decisions: In partner’s decisions are taken by consensus of all partners. So they take appropriate decisions and there is less chance of incorrectness. Fear of unlimited liability encourages caution and care, thus, puts a brake on hasty and reckless decisions.

More Inspiration: There is more inspiration to work because partners think that the result of their hard work will be rewarded in the form of more profits to them.

Close Supervision: The partners themselves look after the business, so they avoid wastage. They have direct access to employees and can encourage them for more production.

Secrecy: The business affairs and accounts of the partnership do not require publicity by law as in companies. So, partners can keep business secrets within themselves.

Flexible : In partnership firm, there can be any change in managerial set-up, capital, and scale of production. These changes can be made by the mutual agreement between partners. Thus, it enjoys flexibility.

Protection of Minority Interests: Every partner has a right to participate in the management of the business. All important decisions are taken by the consent of all partners. In event of disagreement minority may even Veto a resolution. Hence, it protects the interest of minor partners.

Reduced Risk: The losses incurred by the firm will be shared by all partners. So loss of each partner will be less in comparison to sole trading concern.

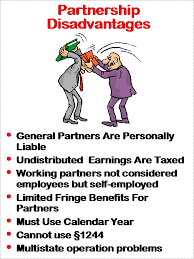

Disadvantages of Partnership

The disadvantages of partnership firm are as given below:

Uncertain Existence: The partnership firm suffers from the uncertain existence because it can be dissolved at the time of death of insolvency of partner. Thus, the life, of the firm is dependent on the life of the partners. In the same way a business may terminate due to dishonesty of a partner or conflict among partners.

Unlimited Liability: The liability of partners is unlimited. The partners are jointly and separately liable for the debts of the firm. So they try to avoid risks and restrict the expansion and growth of the business.

Difficulty in Prompt:Decisions: All important decisions are taken by the consent of all partners. So decisions making process becomes time consuming and loss of business opportunities due to delay in decision making. Usually in business, the spontaneous decisions can only enable the firm to enjoy higher profits, which is not possible in partnership.

Danger of Disputes: Many persons are owners of a partnership firm. Every partner wants to show his importance. Misunderstanding and jealous tendencies are the common weaknesses of the human beings. So there is always a danger dispute among them which may lead business to an end.

Difficulty on Transfer of Shares: A partner cannot transfer his or leave the firm shares without the consent of all other partners. The consent of all other partners is compulsory. So people do not want to invest money in a partnership business.

Risk of Implied Authority: A dishonest or unskilled partner may lead the firm in problems. The other partners will have to meet the obligations incurred by the partner. The provision of indirect authority may make problems for the business.

Lack of Public Confidence: The public does not have much confidence in a partnership business. This is because affairs of a partnership business are not open to public scrutiny. Its accounts are not required to be published. There is no much governmental control over the operations of a partnership.

Limited Resources : Modern business needs large amount of capital. But in partnership the resources are limited to the personal funds of the partners. Borrowing capacity of partners is also limited. Even though the capital is more in partnership than in case of sole trading, but still is not sufficient for the smooth conduct and operation of large-scale business.