What is Accrual basis of Accounting?

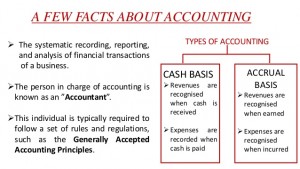

Accrual Basis Accounting is an accounting method or its a system whereby revenues are recognized when earned and expenditures are recognized in the period incurred, without regard to the time of receipt or payment of cash. This method of accounting allows a more accurate evaluation of operations during a given fiscal period. Accrual accounting may be based on one of two methods: full accrual or modified accrual.

The term “full accrual” is sometimes employed and can have one of two meanings. Either an extensive number of categories in both revenues and expenditures are accrued and/or this activity is continuous (daily) rather than periodic. Increasing the degree of complexity of financial reporting creates an associated cost in the posting, recording, and balancing of more accounts. Full accrual is typically used in enterprise and agency funds as a number of major items that are considered expenses in a full costing system such as depreciation need to be recognized.

Modified accrual accounting falls between the cash basis and the full accrual basis and is the most common accrual basis used by school districts. In modified accrual accounting, most revenues and expenditures may be handled on a “cash” basis for daily processing and converted to an accrual basis by periodic adjustments. The determination of how frequently the adjustments will be made is a value judgment that depends on the significance of the items, the purposes for the accounting, the need to reflect the operations of the enterprise, and the associated cost and complexity of the system.

You may Also like to Read

what is accrual accounting method:

Accrual accounting method is the process of recording transaction. below given examples show the method of recording transactions on accrual basis.

Accrual Basis of Accounting Examples

1. Travel agent agency sells its air ticket days or even weeks before the flight is made, but it does not record the receipts as revenue because the flight, the event on which the revenue is based has not occurred yet.

The Travel agent agency pass the following journal entry:

| Bank/Cash a/c | XYZ | |

| Unearned revenue a/c | XYZ |

Another example of Accrual Basis of accounting is;

2. Unearned revenue is a current liability which extinguishes when the flight is made.

| Unearned revenue | XYZ | |

| Revenue | XYZ |

3. An NGO obtained its office on rent and paid Rs170,000 on January 1 as annual rent. It does not record the payment as an expense because the building is not yet used. Instead it records the cash payment as prepaid rent (which is a current asset):

| Prepaid rent | XYZ | |

| Bank | XYZ |

what is the purpose of Accrual Accounting:

Cash Basis Accounting:

The cash basis of accounting is the most elementary form of accounting and is typically used by individuals, small businesses, and school districts. Under the cash basis, revenues are recorded when received and expenditures are recorded when cash is paid.

The virtue of cash accounting is its simplicity. As accounting is not performed until cash is received or spent, the relationship of revenues and expenses to the accounting period in question is dependent on the actual flow of cash.

This system makes no provision for non-cash transactions; therefore, the accounting reports may provide inadequate information for control purposes and may limit analysis of the financial condition of the entity.

Cash Basis Accounting Examples:

Accrual Basis vs Cash Basis Accounting:

The primary difference between accrual-basis and cash-basis accounting is are given below:

| Basis |

Accrual Basis Accounting |

Cash Basis Accounting |

| Uses | It is widely used. | It is rarely used. |

| Transactions | It records both cash and credit transactions. | It records only cash transactions. |

| Standard | It follows international accounting standard. | It does not follow international accounting standard |

| Cash Flows | It ensures company’s both cash flows and accrual flows. | It ensures company’s total cash flows. |

| Limitation | It completely presents company overall financial changes over a specific period. | It does not present company overall financial changes over a specific period. |

This is how is cash basis accounting different from accrual basis accounting.