Difference between Trial Balance and Balance Sheet

Trial Balance Vs Balance Sheet

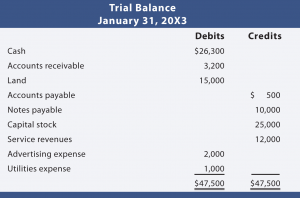

Trial Balance:

The Trial balance is prepared by extracted the balances from the ledger accounts, it shows the summary of the ledger accounts but does not show the financial position of a business. It is usually prepared at the end of an accounting period to assist in the drafting of financial statements.

Ledger balances are segregated into debit balances and credit balances. Asset and expense accounts appear on the debit side of the trial balance whereas liabilities, capital and income accounts appear on the credit side. If all accounting entries are recorded correctly and all the ledger balances are accurately extracted, the total of all debit balances appearing in the trial balance must equal to the sum of all credit balances.

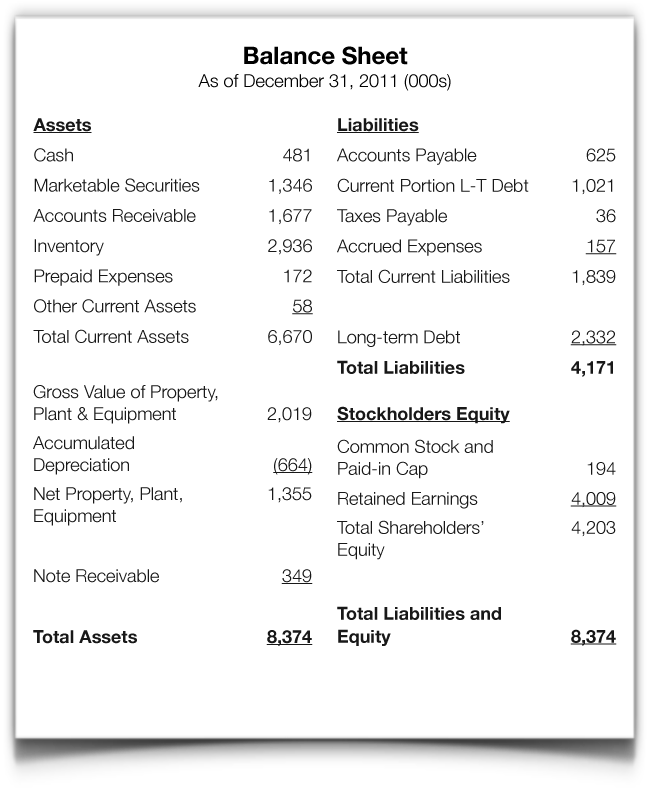

Balance Sheet:

The balance sheet is prepared at the end of year, its shows the financial position of the business, A Balance Sheet lists the assets, liabilities and equity of a company at a specific point in time and is used to calculate the net worth of a business. A basic tenet of double-entry book-keeping is that total assets

(what a business owns) must equal liabilities plus equity (how the assets are financed).

In other words, the balance sheet must balance. Subtracting liabilities from assets shows the net worth of the business A basic tenet of double-entry bookkeeping is that total assets (what a business owns) must equal liabilities plus equity (how the assets are financed). In other words, the balance sheet must balance.

The following points will help you to understand the difference between trial balance and balance sheet.

Trial Balance Vs Balance Sheet

Trial Balance |

Balance Sheet |

|

|