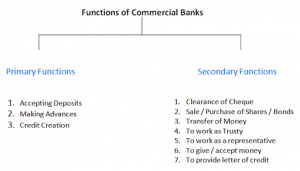

Functions of Commercial bank

A bank is a financial institution which deals with the money and credit. It is organized on a joint stock company system primarily for the earning of profit. The main function of commercial bank is to accept deposits from individuals, firm and companies at lower rate of interest and gives at higher rate of interest to those who need them. The different between the term at which it borrow and those at which lends forms the source of its profit.

The following are the Functions Commercial bank ;

1.Accepting of Deposits:

The basic function or primary function of commercial bank is to accept deposits from these who can save but cannot make profitable use of their saving themselves. In order to attract the saving from different persons and institution bank offers interest/profit on the saving according to terms and condition.

2.Making Loans:

The basic function or primary function of commercial bank is to make loans to businessmen, traders, household’s etc .these loans are made against document of title to goods, marketable securities, personal security of the borrowers etc of all the function of the modern banking advancing or lending is the most important. The strength of a bank is primarily judged by the soundness of its advances.

You May Also like to Read:

3.Cash credit:

It is a very common form of borrowing by business concerns. The banks advance long term loans to the commercial and industrial units against the security of goods. The borrower is permitted to draw within the cash credit limit sanctioned by the bank. The interest is charged only on the amount of money withdrawn by the borrower.

4.Overdraft:

It is a short term of financing by a bank. Under this facility a customer may arrange with his bank to permit him to over draw on his current account, known as an overdraft. The bank allows customer to overdraw his account up to a certain limit on providing security of shares, insurance policies deposit receipt etc

The difference between cash credit and overdraft is that cash credit is given on regular basis and for long term. The overdraft facility is for a short period.

5.Discounting of bills:

The bank also makes loans to their customer by discounting bills of exchange. Discounting of bills refers to making the payment of bill before its maturity .the discount charged is the earning of the bank. The premature payment made is a loan to the holder of the bill. Discount of bills by bank is considered it safe, certain and liquid form of bank lending.

6.Agency Functions:

Bank act as an agent of their customer in various ways,

a.Cheques collection:

It acts as agent sot its customer in the collection and payment of cheques bills and promissory notes.

b.Dividends collection:

The bank provides a very useful service in the collection of dividend or interest earned on shares held by its customer.

c.Purchase or sales:

The bank purchases or sells securities on his behalf and thus adds another benefit to its portfolio.

d.Instruction:

The customer may order in writing to his bank to make payment of regularly recurring nature to an individual or firm by debiting them to his account. The bank will make payments and charge a small commission. The payments will be strapped on written instruction of the strummer only.